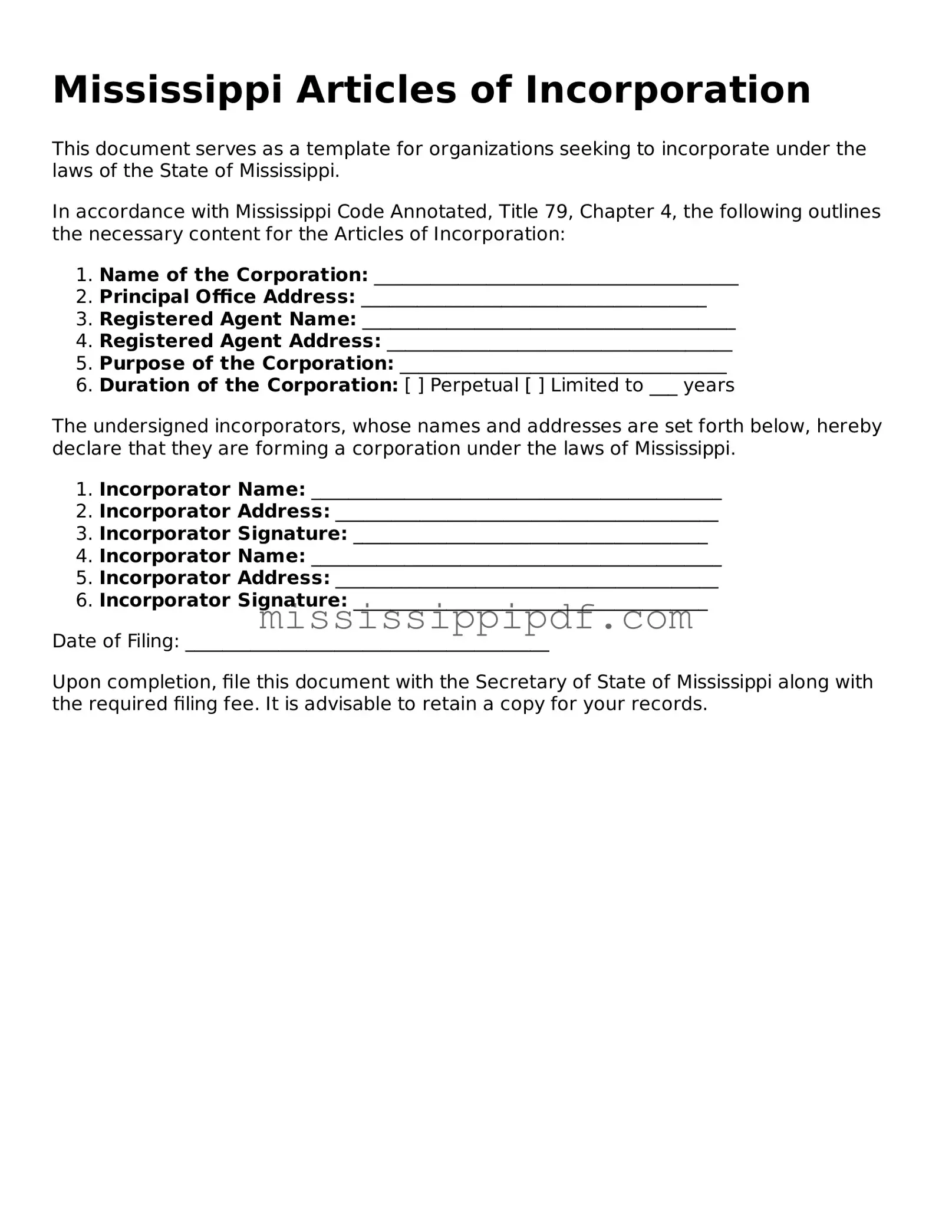

Fillable Articles of Incorporation Template for Mississippi

Popular Mississippi Templates

Ms Boat Bill of Sale - Generally includes information like boat make, model, and VIN.

How to Transfer a Deed in Mississippi - Irrevocable deeds cannot be changed after execution.

In today's competitive job market, having a well-structured Employment Application PDF form is essential for any job seeker. This document not only allows candidates to present their personal and professional information but also simplifies the hiring process for employers. By incorporating an Employment Application Form, candidates can ensure they meet the expectations of potential employers while showcasing their qualifications effectively.

Last Will and Testament Mississippi - Prepare for the unexpected with a comprehensive Last Will and Testament.

Misconceptions

Understanding the Mississippi Articles of Incorporation form is essential for anyone looking to start a business in the state. However, several misconceptions can lead to confusion. Here are nine common misconceptions clarified:

- All businesses must file Articles of Incorporation. Many believe that every business entity must file this form. In reality, only corporations are required to submit Articles of Incorporation. Other business structures, like sole proprietorships or partnerships, do not need to file this document.

- The Articles of Incorporation are the same as a business license. Some people confuse these two documents. While the Articles of Incorporation establish the existence of a corporation, a business license is a separate permit that allows a business to operate legally in a specific area.

- Filing Articles of Incorporation guarantees business success. Many assume that simply filing this form will lead to a successful business. Success depends on various factors, including market research, business planning, and effective management.

- Once filed, Articles of Incorporation cannot be changed. This misconception suggests that the form is permanent. In fact, amendments can be made to the Articles of Incorporation if changes are necessary, such as altering the business name or structure.

- The filing fee is the same for all corporations. Some believe that every corporation pays the same amount when filing. Fees can vary based on the type of corporation and other factors, so it’s important to check the current fee schedule.

- Articles of Incorporation are only necessary for large businesses. This is not true. Small businesses and startups also need to file Articles of Incorporation if they choose to operate as a corporation.

- Filing Articles of Incorporation is a quick process. Many think that the process is instantaneous. However, it can take several days or even weeks for the state to process the filing, depending on their workload and the accuracy of the submitted documents.

- You can file Articles of Incorporation without legal assistance. While it is possible to file without a lawyer, many people benefit from consulting with a professional. Legal guidance can help ensure that all requirements are met and that the form is filled out correctly.

- All states have the same Articles of Incorporation requirements. This misconception overlooks the fact that each state has its own rules and requirements for filing. It is crucial to understand Mississippi's specific guidelines when preparing the Articles of Incorporation.

By addressing these misconceptions, individuals can better navigate the process of incorporating a business in Mississippi.

Documents used along the form

When forming a corporation in Mississippi, several additional forms and documents may be required alongside the Articles of Incorporation. Each of these documents plays a crucial role in ensuring compliance with state regulations and facilitating the smooth operation of the corporation.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. Bylaws govern the responsibilities of directors and officers, meeting protocols, and shareholder rights.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This report typically includes information about the corporation's officers, directors, and registered agent.

- Financing Options: When considering financing for your corporation, you may want to explore various options, including loans secured by a Promissory Note form that outlines specific terms and conditions for repayment.

- Employer Identification Number (EIN): An EIN is necessary for tax purposes. This number is issued by the IRS and is required for opening bank accounts and filing tax returns.

- Registered Agent Appointment: This document designates a registered agent to receive legal documents on behalf of the corporation. It is essential for maintaining good standing with the state.

- Business License: Depending on the type of business and location, a business license may be required to operate legally. This document ensures compliance with local regulations.

- Shareholder Agreement: This agreement outlines the rights and obligations of shareholders, including how shares can be transferred and how decisions are made within the corporation.

- Operating Agreement: While more common for LLCs, some corporations may also benefit from an operating agreement, detailing the management structure and operational procedures.

- Annual Report: Many states require corporations to file an annual report, which updates the state on the corporation's activities, financial status, and any changes in leadership or structure.

Each of these documents serves a specific purpose in the formation and ongoing management of a corporation in Mississippi. Ensuring that all necessary paperwork is completed accurately and submitted on time is vital for maintaining compliance and protecting the corporation's interests.

File Overview

| Fact Name | Details |

|---|---|

| Purpose | The Mississippi Articles of Incorporation form is used to establish a corporation in the state of Mississippi. |

| Governing Law | This form is governed by the Mississippi Business Corporation Act, specifically Title 79, Chapter 4 of the Mississippi Code. |

| Required Information | To complete the form, you must provide the corporation's name, purpose, registered agent, and the number of shares authorized. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which can vary based on the type of corporation. |

| Submission Method | The completed form can be submitted online, by mail, or in person to the Mississippi Secretary of State's office. |

Key takeaways

Ensure that you have a clear business name. The name must be unique and not already in use by another corporation in Mississippi.

Designate a registered agent. This person or business must have a physical address in Mississippi and will receive legal documents on behalf of the corporation.

Provide the purpose of your corporation. Be specific about what your business will do, as this information is crucial for legal and tax purposes.

Include the number of shares the corporation is authorized to issue. This affects ownership structure and can impact future fundraising efforts.

List the names and addresses of the incorporators. These individuals are responsible for setting up the corporation and must sign the form.

File the form with the Mississippi Secretary of State. This can be done online or by mail, and a filing fee is required.

Understand the importance of the effective date. You can specify a future date for the corporation to begin operations, but it cannot be more than 90 days after filing.

Keep a copy of the filed Articles of Incorporation. This document serves as proof of your corporation's existence and is essential for legal and administrative purposes.

Similar forms

The Articles of Incorporation in Mississippi serve a fundamental purpose in the formation of a corporation, similar to the Certificate of Incorporation in other states. This document outlines the basic details of a corporation, such as its name, purpose, and registered agent. Both documents establish the corporation as a legal entity separate from its owners, allowing it to conduct business, enter contracts, and protect its owners from personal liability. Each state may have specific requirements, but the core function remains consistent across jurisdictions.

Another document akin to the Articles of Incorporation is the Bylaws of a corporation. While the Articles of Incorporation provide the foundational information necessary to create a corporation, the Bylaws detail the internal rules and procedures governing the corporation's operations. Bylaws cover aspects such as the management structure, voting rights, and procedures for meetings. Together, these documents ensure both external recognition and internal governance of the corporation.

The Operating Agreement is similar to the Articles of Incorporation but is specific to Limited Liability Companies (LLCs). This document outlines the management structure, ownership percentages, and operational guidelines for the LLC. Like the Articles of Incorporation, the Operating Agreement helps establish the entity as separate from its owners, providing liability protection and clarity on how the business will function.

The Partnership Agreement shares similarities with the Articles of Incorporation in that it formalizes the relationship between partners in a business. This document outlines the roles, responsibilities, and profit-sharing arrangements among partners. While it does not create a separate legal entity like a corporation, it serves to clarify the expectations and obligations of each partner, much like how Articles of Incorporation clarify the structure of a corporation.

The Certificate of Formation, often used in states that do not have Articles of Incorporation, serves a similar purpose. This document is essential for establishing a business entity, whether it be a corporation or an LLC. It typically includes the business name, registered agent, and purpose, aligning closely with the information found in Articles of Incorporation, ensuring the business is recognized legally.

Another related document is the Statement of Information, which some states require after the Articles of Incorporation are filed. This document updates the state on key information about the corporation, such as its address, officers, and directors. While the Articles of Incorporation provide initial details, the Statement of Information keeps the state informed about any changes in the corporation's structure or operations.

For a seamless transaction, you may find it helpful to utilize the Trailer Bill of Sale essential template available here.

The Certificate of Good Standing is also relevant. This document verifies that a corporation is legally registered and compliant with state regulations. It is often required for business transactions, such as securing loans or entering contracts. While not an initial formation document like the Articles of Incorporation, it serves to confirm that the corporation is recognized and in good standing with the state.

The Franchise Tax Registration is another document that bears similarity to the Articles of Incorporation, as it often must be filed alongside or shortly after the incorporation process. This registration ensures that the corporation is compliant with state tax obligations. While the Articles of Incorporation establish the entity, the Franchise Tax Registration ensures that the entity is recognized for tax purposes and fulfills its financial responsibilities to the state.

Lastly, the Business License is a document that, while not directly related to the incorporation process, is essential for legal operation. It signifies that a business has met local regulations and is authorized to conduct business in a specific jurisdiction. Like the Articles of Incorporation, a business license is crucial for legal recognition and operation, ensuring that the business adheres to local laws and regulations.