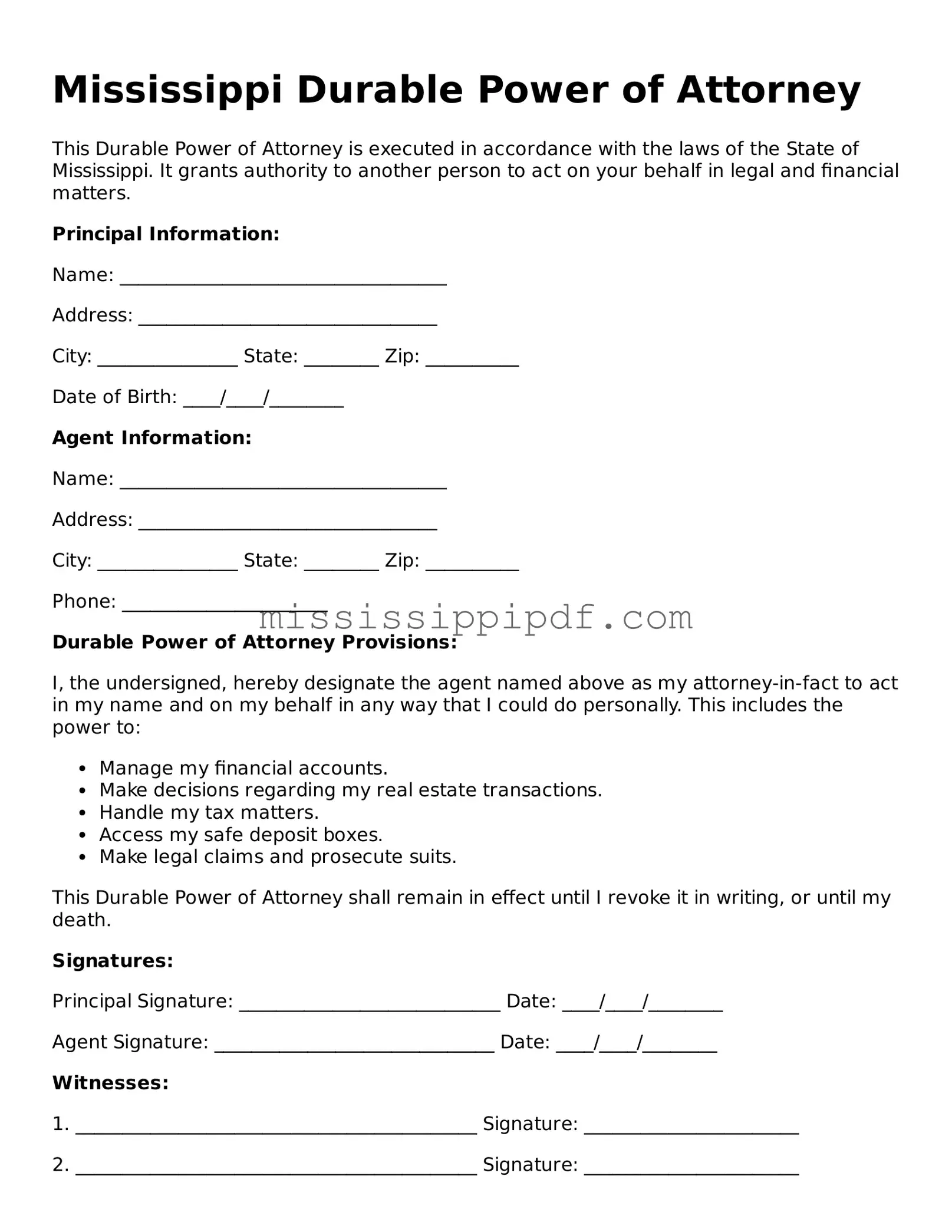

Fillable Durable Power of Attorney Template for Mississippi

Popular Mississippi Templates

Ms Boat Bill of Sale - Generally, considered a best practice in any boat sale transaction.

To ensure a transparent and efficient transaction in the transfer of vehicle ownership, it's crucial to utilize the appropriate documentation, such as the Motor Vehicle Bill of Sale form. For those in Arizona, this can be easily obtained through resources like Arizona PDFs, which offer templates that can streamline the process and ensure all necessary details are accurately captured.

Notary Page for Document - A Notary Acknowledgement supports the validity of a contract.

Misconceptions

- Misconception 1: A Durable Power of Attorney is only for the elderly.

- Misconception 2: The agent has unlimited power over my finances.

- Misconception 3: A Durable Power of Attorney is the same as a regular Power of Attorney.

- Misconception 4: I can create a Durable Power of Attorney without legal assistance.

- Misconception 5: A Durable Power of Attorney automatically ends when I recover.

- Misconception 6: My agent must be a family member.

- Misconception 7: A Durable Power of Attorney can only be used for financial matters.

This form can be beneficial for anyone, regardless of age. It allows individuals to designate someone to manage their affairs if they become incapacitated.

The powers granted to the agent are specified in the document. You can limit their authority to certain transactions or areas of your finances.

A Durable Power of Attorney remains effective even if you become incapacitated, while a regular Power of Attorney does not.

While it is possible to create one on your own, consulting a legal professional ensures that the document meets all legal requirements and adequately reflects your wishes.

This document remains in effect until you revoke it or pass away, even if you regain capacity.

You can choose anyone you trust to be your agent, whether a family member, friend, or professional advisor.

This form can also cover health care decisions if you include specific provisions for medical decisions in the document.

Documents used along the form

When individuals in Mississippi decide to establish a Durable Power of Attorney, they often consider several other forms and documents that complement this important legal tool. Each of these documents serves a distinct purpose, ensuring that an individual’s wishes are respected and that their affairs are managed effectively in various situations.

- Advance Healthcare Directive: This document outlines an individual's preferences regarding medical treatment and end-of-life care. It provides guidance to healthcare providers and family members when the individual cannot communicate their wishes.

- Living Will: A specific type of advance directive, a living will details what types of medical treatment an individual does or does not want in the event of a terminal illness or incapacitation.

- HIPAA Authorization: This form allows individuals to grant permission for healthcare providers to share their medical information with designated persons. It ensures that loved ones can access necessary health information when needed.

- Articles of Incorporation: To establish a corporation in California, it's essential to fill out the required legal document, which outlines the corporation's name, purpose, and structure. You can begin this process by visiting California Templates.

- Last Will and Testament: This legal document specifies how a person's assets and affairs should be handled after their death. It can name guardians for minor children and outline specific bequests to beneficiaries.

- Revocable Living Trust: A trust allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death, often avoiding probate.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically focuses on financial matters, allowing a designated person to manage financial affairs on behalf of the individual.

- Property Deed: A property deed transfers ownership of real estate from one party to another. It is essential for ensuring that property rights are clearly defined and legally recognized.

Incorporating these documents into estate planning can provide comprehensive coverage for various personal and financial matters. Together, they create a framework that respects individual autonomy and ensures that preferences are honored, even when one cannot voice them directly.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Mississippi Durable Power of Attorney allows an individual to designate someone to manage their financial affairs if they become incapacitated. |

| Governing Law | The form is governed by Mississippi Code Annotated § 87-3-1 through § 87-3-25. |

| Durability | This document remains effective even if the principal becomes incapacitated, unlike a regular power of attorney. |

| Principal and Agent | The person creating the document is called the principal, while the individual designated to act on their behalf is the agent. |

| Execution Requirements | The form must be signed by the principal and acknowledged before a notary public. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent. |

| Limitations | Some actions, such as making a will or altering a trust, cannot be delegated through this form. |

Key takeaways

Here are key takeaways about filling out and using the Mississippi Durable Power of Attorney form:

- The form allows you to appoint someone to make decisions on your behalf if you become unable to do so.

- Choose a trusted individual as your agent. This person will have significant authority over your financial and legal matters.

- Clearly specify the powers you wish to grant. You can limit or expand the authority as needed.

- Sign the document in the presence of a notary public. This step is crucial for the form to be valid.

- Consider including a successor agent. This person will step in if your primary agent is unable or unwilling to serve.

- Review the form periodically. Changes in your life or preferences may require updates to the document.

- Keep copies of the signed form in a safe place. Provide copies to your agent and any relevant financial institutions.

- The Durable Power of Attorney remains effective even if you become incapacitated, unlike a regular power of attorney.

- Understand that your agent has a fiduciary duty to act in your best interest.

- Consult with a legal professional if you have questions about the form or its implications.

Similar forms

The Mississippi Durable Power of Attorney (DPOA) form shares similarities with a standard Power of Attorney (POA) document. Both types of forms allow an individual, known as the principal, to appoint someone else, called an agent, to make decisions on their behalf. However, the key difference lies in durability. While a standard POA may become invalid if the principal becomes incapacitated, a DPOA remains effective even in such situations. This feature makes the DPOA particularly useful for long-term planning and ensuring that the agent can continue to act in the principal's best interest when they are unable to do so themselves.

For those interested in the transfer of trailer ownership, the process is streamlined by utilizing the detailed California Trailer Bill of Sale form. This document plays a crucial role in outlining the specifics of the sale and ensuring that all necessary information is accurately documented for both parties.

Another document that resembles the DPOA is the Healthcare Power of Attorney (HPOA). This specific type of power of attorney focuses solely on medical decisions. Like the DPOA, it allows the principal to designate someone to make healthcare choices if they become unable to communicate their wishes. The HPOA is crucial for ensuring that medical care aligns with the principal’s values and preferences. In contrast to the DPOA, which can cover financial and legal matters, the HPOA is limited to health-related decisions, making it a vital tool for those concerned about their medical care.

The Living Will is another document that shares a connection with the DPOA. While the DPOA grants an agent the authority to make decisions on behalf of the principal, a Living Will specifically outlines the principal’s wishes regarding end-of-life care and medical treatment preferences. This document serves as a guide for healthcare providers and loved ones, ensuring that the principal’s desires are honored when they can no longer express them. In essence, while the DPOA allows someone to act on behalf of the principal, the Living Will communicates the principal's own choices about their medical treatment.

Lastly, the Revocable Trust is similar in that it involves planning for the management of assets, but it operates differently than a DPOA. A Revocable Trust allows individuals to place their assets into a trust that they can manage during their lifetime. If they become incapacitated, a successor trustee can step in to manage the trust without the need for court intervention. While the DPOA grants authority to an agent to handle financial matters, a Revocable Trust provides a structured way to manage and distribute assets, ensuring a smoother transition of control and potentially avoiding probate. Both documents serve to protect the principal’s interests but do so in distinct ways.