Fillable General Power of Attorney Template for Mississippi

Popular Mississippi Templates

How to Create an Operating Agreement - A thorough Operating Agreement minimizes ambiguity in decision-making processes.

For a smooth transition in trailer ownership, consider utilizing a reliable essential Trailer Bill of Sale document that outlines all necessary details for the transaction. You can find the form at this essential Trailer Bill of Sale resource.

How Do I Get a Dnr Form - A patient's healthcare proxy, if designated, can play a significant role in ensuring the DNR order is communicated effectively to medical teams.

Misconceptions

When considering a Mississippi General Power of Attorney (GPOA) form, it's important to understand the common misconceptions that can lead to confusion. Here are five prevalent misunderstandings:

- Misconception 1: A General Power of Attorney is the same as a Durable Power of Attorney.

- Misconception 2: The agent can do anything they want with the principal's assets.

- Misconception 3: A General Power of Attorney can only be created for financial matters.

- Misconception 4: Once a General Power of Attorney is signed, it cannot be revoked.

- Misconception 5: A General Power of Attorney is only necessary for the elderly.

This is not true. A General Power of Attorney typically becomes invalid if the principal (the person granting the authority) becomes incapacitated. In contrast, a Durable Power of Attorney remains effective even if the principal is unable to make decisions.

While the agent does have broad authority to act on behalf of the principal, their actions must align with the principal's best interests and the specific powers granted in the document. Misuse of authority can lead to legal consequences.

This is incorrect. A GPOA can cover a wide range of decisions, including healthcare and personal affairs, depending on how the document is drafted. The principal can specify the areas in which the agent has authority.

This is a misunderstanding. The principal has the right to revoke a GPOA at any time, as long as they are mentally competent. Revocation should be done in writing and communicated to the agent and relevant parties.

This is a common belief, but anyone can benefit from a GPOA. Unexpected events, such as accidents or sudden illnesses, can occur at any age, making it wise for individuals to have a plan in place for decision-making.

Documents used along the form

When creating a General Power of Attorney in Mississippi, it is often beneficial to consider additional forms and documents that can complement this legal tool. These documents can help clarify intentions, provide additional authority, or address specific situations. Below is a list of some commonly used forms alongside the General Power of Attorney.

- Durable Power of Attorney: This form allows an individual to grant authority to another person, even if the principal becomes incapacitated. It remains effective until revoked or until the principal's death.

- Health Care Power of Attorney: This document designates someone to make medical decisions on behalf of the principal if they are unable to do so. It focuses specifically on health care matters.

- Living Will: A living will outlines a person's wishes regarding medical treatment in situations where they are unable to communicate their preferences, particularly in end-of-life scenarios.

- Financial Power of Attorney: This form gives someone the authority to handle financial matters, such as managing bank accounts, paying bills, and making investment decisions on behalf of the principal.

- Revocation of Power of Attorney: This document is used to formally revoke any previously granted power of attorney. It is important to ensure that all parties are aware of the revocation.

- Affidavit of Successor Attorney-in-Fact: This form allows for the appointment of a successor if the original attorney-in-fact is unable or unwilling to fulfill their duties.

- Appointment of Guardian: In cases where an individual may need someone to manage their affairs due to incapacity, this document formally appoints a guardian to oversee personal and financial matters.

- Motor Vehicle Bill of Sale: This essential document formalizes the transfer of ownership of a vehicle, ensuring that both parties have a record of the transaction. For more information, visit Arizona PDFs.

- Trust Agreement: A trust agreement can be used to manage assets for the benefit of a beneficiary. This document outlines how the assets are to be handled and distributed.

- Property Transfer Document: This form is used to transfer ownership of property from one individual to another, which may be necessary in conjunction with a power of attorney.

Understanding these documents can provide clarity and ensure that the principal's wishes are respected. Each form serves a specific purpose and can work together to create a comprehensive plan for managing affairs, especially in times of need.

File Overview

| Fact Name | Description |

|---|---|

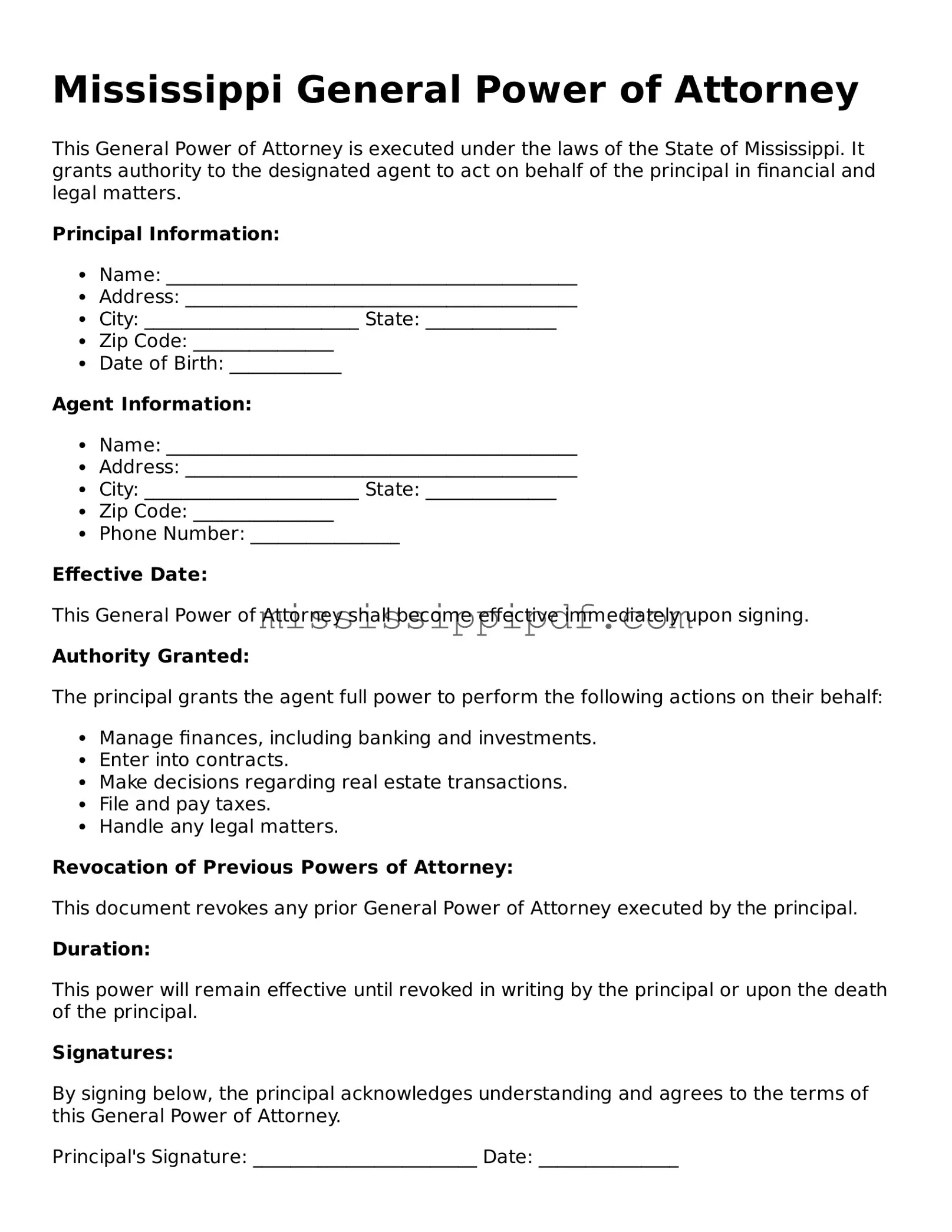

| Definition | A Mississippi General Power of Attorney allows one person to grant another the authority to act on their behalf in various matters. |

| Governing Law | This form is governed by the Mississippi Uniform Power of Attorney Act, found in Mississippi Code Annotated § 87-3-1 et seq. |

| Durability | The General Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated, if specified in the document. |

| Agent's Authority | The agent can perform a variety of tasks, including managing finances, making healthcare decisions, and handling real estate transactions. |

| Revocation | The principal can revoke the General Power of Attorney at any time, as long as they are mentally competent. |

| Signing Requirements | The document must be signed by the principal and acknowledged before a notary public or signed in the presence of two witnesses. |

| Agent's Duties | Agents are required to act in the best interest of the principal and must keep accurate records of all transactions made on their behalf. |

| Limitations | Some powers, such as making a will or changing beneficiaries, cannot be granted through a General Power of Attorney. |

Key takeaways

Filling out a General Power of Attorney form in Mississippi can be straightforward if you keep a few key points in mind. Here are some essential takeaways to help you navigate the process:

- Understand the Purpose: A General Power of Attorney allows you to appoint someone to handle your financial and legal matters when you cannot do so yourself.

- Choose Your Agent Wisely: Your agent should be someone you trust completely, as they will have significant control over your affairs.

- Be Specific: Clearly outline the powers you are granting. This can include handling bank accounts, real estate, or other financial decisions.

- Sign in Front of a Notary: In Mississippi, your Power of Attorney must be signed in front of a notary public to be valid.

- Consider Revocation: You can revoke the Power of Attorney at any time as long as you are mentally competent. Make sure to notify your agent and any institutions involved.

- Keep Copies: After filling out the form, keep copies for yourself and provide copies to your agent and any relevant institutions.

- Review Regularly: Life circumstances change. Regularly review your Power of Attorney to ensure it still meets your needs.

By following these guidelines, you can create a General Power of Attorney that works effectively for your situation.

Similar forms

The Mississippi Durable Power of Attorney is similar to the General Power of Attorney in that it grants authority to an agent to act on behalf of the principal. However, the key distinction lies in its durability. A Durable Power of Attorney remains effective even if the principal becomes incapacitated, ensuring that the agent can continue to manage the principal's affairs without interruption. This feature is particularly important for individuals concerned about future health issues that may impair their decision-making abilities.

For those interested in the formation of a corporation in California, understanding the necessary documents is crucial, and you can find comprehensive resources and assistance at California Templates, which provides fillable forms to simplify the process and ensure all legal requirements are met.

The Mississippi Medical Power of Attorney specifically focuses on healthcare decisions. Like the General Power of Attorney, it designates an agent to make decisions on behalf of the principal. However, the Medical Power of Attorney is limited to medical and health-related matters. This document is essential for individuals who want to ensure their medical preferences are honored if they are unable to communicate those wishes themselves.

The Financial Power of Attorney is another document that shares similarities with the General Power of Attorney. It allows an agent to handle financial transactions and manage the principal’s financial affairs. The Financial Power of Attorney is specifically tailored for financial matters, whereas the General Power of Attorney can cover a broader range of responsibilities. This document is crucial for individuals who need someone to manage their finances, especially in cases of absence or incapacity.

The Limited Power of Attorney is a more restrictive version of the General Power of Attorney. It grants the agent authority to act only in specific situations or for a defined period. This document is useful for individuals who want to delegate authority for a particular transaction, such as selling a property, without giving the agent broad powers. The Limited Power of Attorney ensures that the principal maintains control over their affairs while allowing for necessary delegation.

Finally, the Springing Power of Attorney is similar to the General Power of Attorney but with a unique feature: it only becomes effective under certain conditions, typically when the principal becomes incapacitated. This document provides a safeguard for those who want to maintain control over their affairs until they are no longer able to do so. It offers peace of mind, knowing that authority will only transfer to the agent when truly needed.