Get Mississippi Resale Certificate Form

Common PDF Forms

Ms Vital Records - Non-payment of the search fee results in the application being unprocessed.

To successfully navigate the process of becoming a licensed retailer, businesses must carefully complete the Florida Lottery DOL-129 form, which outlines the necessary steps and documentation required. It is crucial for applicants to fully understand the information requested in this form to ensure compliance with state regulations. For more detailed guidance, businesses can refer to the official resource at floridaforms.net/blank-florida-lottery-dol-129-form.

Sports Physical Exam - It is recommended that all information be printed clearly.

Misconceptions

Understanding the Mississippi Resale Certificate is essential for businesses involved in buying and selling goods. However, there are several misconceptions that can lead to confusion. Here’s a list of nine common misunderstandings about this important document:

- Only retailers need a Resale Certificate. Many people think that only retail businesses require this certificate. In reality, any business that buys goods for resale, including wholesalers and service providers, may need one.

- The Resale Certificate eliminates sales tax entirely. Some believe that by using this certificate, they are exempt from all sales tax. However, it only applies to purchases intended for resale. If the goods are used or consumed, sales tax still applies.

- Once issued, the Resale Certificate is valid indefinitely. This is not true. The certificate is valid until it is revoked in writing. Businesses should regularly review their certificates to ensure they are still applicable.

- All purchases can be made using a Resale Certificate. This is a misconception. The certificate can only be used for items that are intended for resale. Using it for personal purchases or items not meant for resale can lead to penalties.

- Only certain items qualify for resale. Some think that only specific products can be purchased tax-free with a Resale Certificate. In fact, any tangible personal property or service intended for resale qualifies.

- Filling out the form is optional. Some may believe that completing the Resale Certificate is not necessary. However, the certificate must be filled out completely and signed to be valid.

- The seller is responsible for verifying the certificate. While sellers should check the validity of the certificate, the purchaser is ultimately responsible for ensuring that the certificate is used correctly.

- Using a Resale Certificate is a guarantee against audits. Many think that having this certificate protects them from audits or penalties. However, it does not provide immunity. Businesses must still comply with all tax regulations.

- Resale Certificates are the same in every state. This is a common misunderstanding. Each state has its own rules and forms for resale certificates, and businesses must comply with the specific requirements of Mississippi.

By understanding these misconceptions, businesses can better navigate the complexities of sales tax and ensure compliance with Mississippi regulations. Always consult with a tax professional if there are any uncertainties regarding the use of the Resale Certificate.

Documents used along the form

The Mississippi Resale Certificate is an important document for businesses engaged in the resale of goods or services. Along with this certificate, several other forms and documents may be required to ensure compliance with state regulations. Below is a list of related documents that are often used in conjunction with the Mississippi Resale Certificate.

- Sales Tax Permit Application: This form is necessary for businesses that wish to collect sales tax on behalf of the state. It provides the state with information about the business, including its name, address, and type of goods or services sold.

- Sales Tax Return: Businesses must file this document periodically to report the sales tax collected during a specific period. It details the total sales, taxable sales, and the amount of tax due to the state.

- Purchase Order: This document serves as a formal request for the purchase of goods or services. It outlines the specifics of the transaction, including quantities, prices, and delivery terms, and is essential for record-keeping.

- Residential Lease Agreement Form: For those looking to rent properties in California, the crucial Residential Lease Agreement provisions are essential to protect both landlord and tenant interests.

- Vendor Agreement: This contract outlines the terms and conditions between a buyer and a seller. It may include details about pricing, delivery schedules, and responsibilities of both parties, ensuring clarity in the business relationship.

Understanding these documents can help businesses navigate their responsibilities regarding sales tax and maintain compliance with state laws. Proper documentation is key to ensuring smooth transactions and minimizing potential issues with tax authorities.

Document Data

| Fact Name | Description |

|---|---|

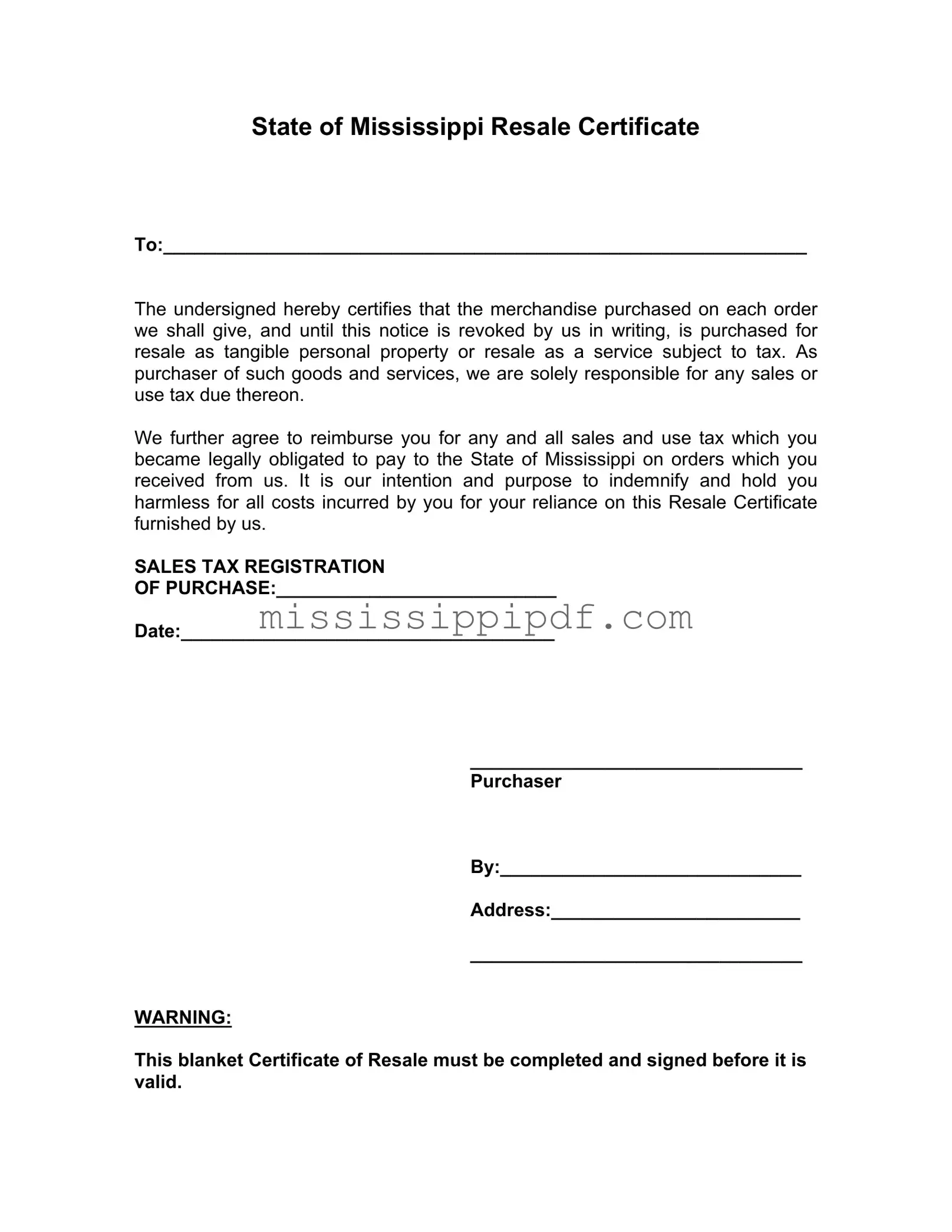

| Purpose | The Mississippi Resale Certificate is used by purchasers to certify that they are buying goods or services for resale, not for personal use. |

| Legal Basis | This form is governed by Mississippi sales tax laws, specifically under the Mississippi Code Annotated Section 27-65-19. |

| Validity Requirement | The certificate must be completed and signed by the purchaser to be considered valid for tax purposes. |

| Tax Responsibility | The purchaser is responsible for any sales or use tax that may be due on the items purchased. |

| Indemnification Clause | The form includes a clause where the purchaser agrees to indemnify the seller for any sales tax obligations incurred due to reliance on the certificate. |

| Sales Tax Registration | Purchasers must provide their sales tax registration number on the form to validate their status as a reseller. |

| Revocation | The purchaser can revoke the certificate at any time by providing written notice to the seller. |

Key takeaways

When using the Mississippi Resale Certificate form, keep the following key points in mind:

- Purpose of the Certificate: This form certifies that the items purchased are intended for resale, either as tangible personal property or as a service subject to tax.

- Sales Tax Responsibility: As the purchaser, you take on the responsibility for any sales or use tax that may be due on the items you buy.

- Indemnification Clause: By submitting this certificate, you agree to reimburse the seller for any sales and use tax they may have to pay due to your purchases.

- Completion Requirement: The certificate must be fully completed and signed to be considered valid. Ensure all necessary fields are filled out before submission.

- Revocation Notice: The certificate remains effective until you revoke it in writing. Keep track of any changes in your business status that might require an update.

Understanding these key takeaways can help ensure that you properly fill out and utilize the Mississippi Resale Certificate, minimizing potential issues with sales tax obligations.

Similar forms

The Texas Resale Certificate serves a similar purpose to the Mississippi Resale Certificate. It allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. The Texas form requires the purchaser to certify that they are a registered seller and will not use the items for personal consumption. This document also protects the seller from being liable for sales tax on the transaction, as long as the certificate is valid and properly completed.

The California Resale Certificate is another document that aligns closely with the Mississippi form. Like its Mississippi counterpart, it allows retailers to buy products tax-free when they intend to resell them. The California form requires the buyer to provide their seller's permit number, ensuring that the transaction is legitimate. It serves to exempt the buyer from sales tax, thereby safeguarding the seller from potential tax liabilities.

In Florida, the Resale Certificate functions similarly by allowing businesses to purchase items for resale without incurring sales tax at the time of purchase. The Florida form mandates that the purchaser include their sales tax registration number. This ensures compliance and protects the seller from any tax obligations, as long as the certificate is properly filled out and signed.

The New York Resale Certificate also mirrors the Mississippi form in its intent and function. This certificate allows businesses to purchase goods intended for resale without paying sales tax upfront. The New York form requires the purchaser to provide their sales tax identification number, which helps confirm their status as a seller. This protects the seller from tax liability as long as the certificate is valid and accurate.

The Illinois Resale Certificate is yet another document that serves a similar function. It allows retailers to buy products without paying sales tax when those products are intended for resale. The Illinois form requires the purchaser to provide their registration number, ensuring that the seller is protected from tax obligations. This form must be completed correctly to be valid, just like the Mississippi certificate.

The Ohio Resale Certificate operates under similar principles. It allows businesses to purchase items without paying sales tax, provided those items are for resale. The Ohio form requires the purchaser to certify their status as a registered vendor. This ensures that the seller is not held liable for sales tax, as long as the certificate is properly completed and submitted.

The Pennsylvania Resale Certificate shares the same core purpose as the Mississippi form. It allows businesses to acquire goods for resale without incurring sales tax at the point of purchase. The Pennsylvania form requires the buyer to provide their sales tax license number, which confirms their eligibility. This protects the seller from tax liabilities, provided the certificate is valid and filled out correctly.

The Georgia Resale Certificate is another document that functions similarly. It allows businesses to purchase items for resale without paying sales tax upfront. The Georgia form requires the purchaser to provide their sales tax registration number, ensuring compliance. This protects the seller from being liable for sales tax, as long as the certificate is completed accurately and valid.

When managing legal documentation such as resale certificates, it’s important to have access to reliable templates and resources. For those looking to ensure their healthcare preferences are respected, having a Medical Power of Attorney form is essential. You can find a comprehensive guide and a useful template at Arizona PDFs, which helps to clarify the process of designating someone to make healthcare decisions on your behalf.

The South Carolina Resale Certificate also aligns with the Mississippi form's intent. It allows businesses to buy items intended for resale without incurring sales tax. The South Carolina form requires the buyer to provide their sales tax number, which verifies their status as a seller. This document protects the seller from tax obligations, provided it is properly completed and signed.

Finally, the Michigan Resale Certificate serves a similar purpose. It allows retailers to purchase goods for resale without paying sales tax at the time of purchase. The Michigan form requires the purchaser to include their sales tax registration number. This helps confirm their status as a seller, protecting the seller from any potential tax liabilities, as long as the certificate is valid and properly executed.