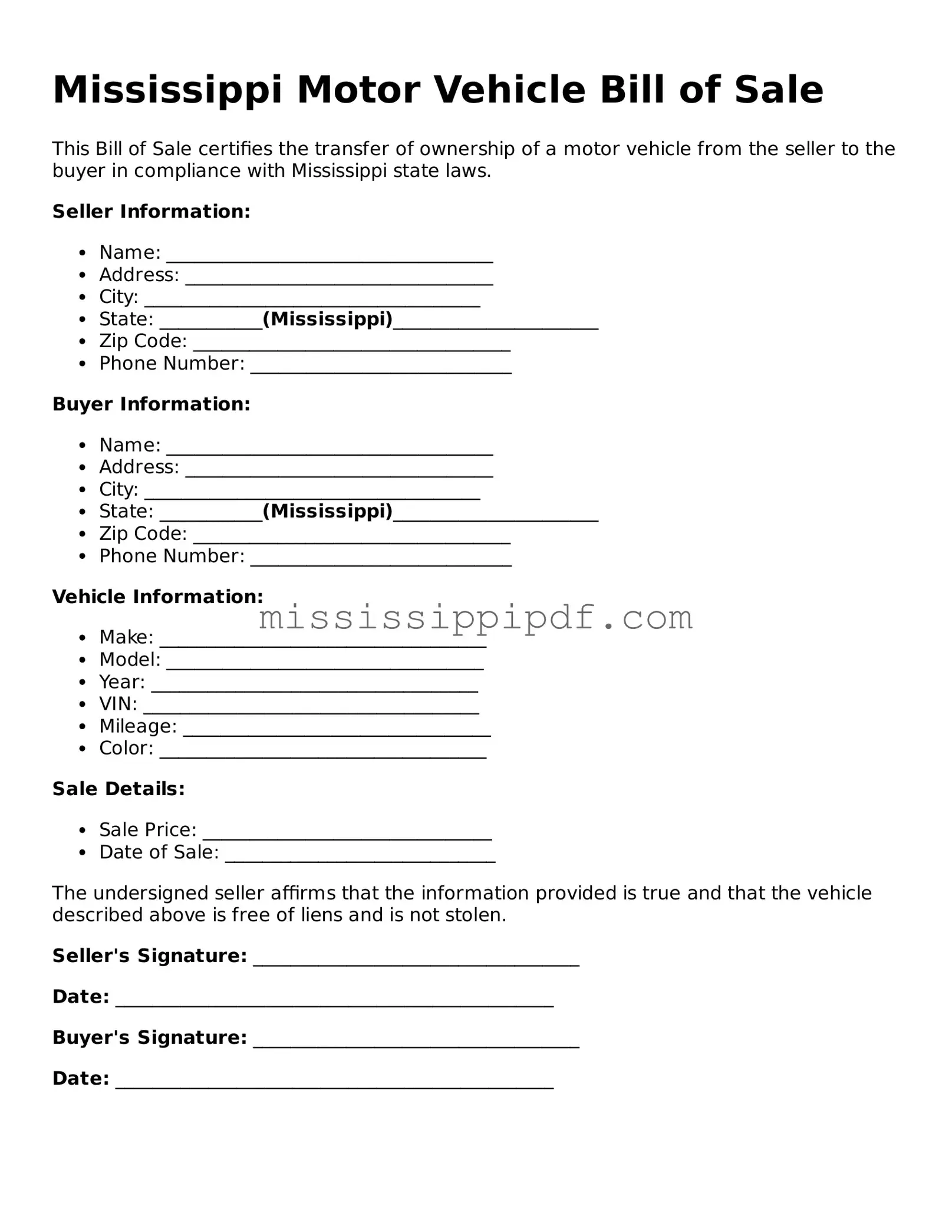

Fillable Motor Vehicle Bill of Sale Template for Mississippi

Popular Mississippi Templates

Ms Boat Bill of Sale - May contain a clause that addresses dispute resolution procedures.

Mississippi Power of Attorney - It can provide peace of mind for those concerned about future health issues.

When engaging in the purchase or sale of a trailer, it's important to understand the necessary documentation involved, including the key Trailer Bill of Sale requirements that facilitate a seamless ownership transfer.

Vehicle Bill of Sale Mississippi - This form can be customized to fit specific needs of the buyer or seller.

Misconceptions

Misconceptions about the Mississippi Motor Vehicle Bill of Sale form can lead to confusion for buyers and sellers alike. Here are ten common misconceptions, along with explanations to clarify each point.

- The Bill of Sale is not necessary for vehicle transactions. Many people believe that a verbal agreement suffices. However, having a written Bill of Sale provides legal protection and serves as proof of the transaction.

- Only the seller needs to sign the Bill of Sale. Some individuals think that only the seller's signature is required. In reality, both the buyer and seller should sign the document to validate the transaction.

- The Bill of Sale is the same as the title. While both documents are important, they serve different purposes. The title proves ownership, while the Bill of Sale documents the sale itself.

- There is a specific form that must be used. Some assume that the state mandates a particular format. Although using a standard form is advisable, any written document that includes the necessary details can suffice.

- All sales are taxable. Many believe that every vehicle sale incurs sales tax. In Mississippi, certain exemptions may apply, such as gifts or sales between family members.

- The Bill of Sale must be notarized. Some think notarization is required for the Bill of Sale to be valid. Notarization is not mandatory in Mississippi, but it can add an extra layer of security.

- The Bill of Sale is only for used vehicles. This misconception suggests that new vehicle transactions do not require a Bill of Sale. In fact, a Bill of Sale is useful for both new and used vehicles.

- Once the Bill of Sale is signed, the buyer is responsible for all liabilities. Some believe that signing the Bill of Sale transfers all liabilities immediately. However, it is important to ensure that the title is also transferred to avoid potential issues.

- A Bill of Sale can be created after the transaction. Many think it is acceptable to draft a Bill of Sale after the sale has occurred. It is best to complete this document at the time of the transaction to avoid disputes.

- Only private sales require a Bill of Sale. Some individuals believe that only transactions between private parties need this document. However, even dealerships often provide a Bill of Sale for their transactions.

Understanding these misconceptions can help ensure smoother vehicle transactions in Mississippi.

Documents used along the form

When completing a vehicle sale in Mississippi, several documents may accompany the Motor Vehicle Bill of Sale form to ensure a smooth transaction. Each document serves a specific purpose and can help protect both the buyer and seller during the process.

- Title Transfer Document: This document is essential for transferring ownership of the vehicle from the seller to the buyer. It includes information about the vehicle, such as its make, model, and VIN, as well as the names and signatures of both parties.

- Odometer Disclosure Statement: This statement is often required to verify the mileage on the vehicle at the time of sale. It helps prevent fraud by ensuring that the buyer is aware of the vehicle's mileage history.

- Employment Verification Form: Including an Employment Verification Form can be crucial for confirming the employment history of buyers who may be acquiring a vehicle through financing.

- Vehicle History Report: While not mandatory, a vehicle history report provides valuable information about the car's past, including any accidents, title issues, or service records. This report can help the buyer make an informed decision.

- Sales Tax Form: In Mississippi, a sales tax form may be required to report the transaction for tax purposes. This form helps ensure that the appropriate taxes are collected based on the sale price of the vehicle.

Having these documents ready can facilitate a more efficient sale and provide peace of mind for both parties involved. Always ensure that all paperwork is completed accurately to avoid any future complications.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The Mississippi Motor Vehicle Bill of Sale form is used to document the sale of a vehicle between a buyer and a seller. |

| Governing Law | This form is governed by Mississippi Code Annotated § 63-21-1 et seq., which outlines the requirements for vehicle transfers. |

| Required Information | Essential details include the vehicle's make, model, year, VIN, and the sale price. |

| Signatures | Both the buyer and seller must sign the form to validate the transaction. |

| Notarization | Notarization is not required for the Bill of Sale in Mississippi, but it can add an extra layer of authenticity. |

| Usage | This form is often used for private sales, providing proof of ownership transfer for the buyer. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records. |

Key takeaways

Understanding the Mississippi Motor Vehicle Bill of Sale form is essential for both buyers and sellers in a vehicle transaction. Here are some key takeaways to consider:

- Legal Requirement: A Bill of Sale is not legally required in Mississippi, but it is highly recommended for documenting the sale of a vehicle.

- Identification Information: Both the buyer and seller must provide their full names, addresses, and contact information on the form.

- Vehicle Details: Include accurate information about the vehicle, such as the make, model, year, Vehicle Identification Number (VIN), and odometer reading.

- Sale Price: Clearly state the agreed-upon sale price. This figure is important for tax purposes and future reference.

- Signatures: Both parties should sign and date the Bill of Sale to validate the transaction. Without signatures, the document may not hold up in disputes.

- Witness or Notary: While not required, having a witness or a notary public can add an extra layer of authenticity to the document.

- Transfer of Ownership: The Bill of Sale serves as proof of ownership transfer. It is advisable to keep a copy for personal records.

- Tax Implications: The sale may be subject to sales tax. Buyers should be aware of their responsibility to pay this tax when registering the vehicle.

- State Regulations: Always check for any specific state regulations or additional forms that may be required for vehicle sales in Mississippi.

By following these key points, individuals can ensure a smoother transaction process when buying or selling a vehicle in Mississippi.

Similar forms

The Mississippi Motor Vehicle Bill of Sale form shares similarities with the general Bill of Sale document. Both serve as legal proof of the transfer of ownership from one party to another. While the Mississippi form is specifically tailored for motor vehicles, a general Bill of Sale can apply to various types of personal property, including furniture, electronics, and other goods. Each document outlines the details of the transaction, including the parties involved, a description of the item being sold, and the sale price, ensuring clarity and legal protection for both buyer and seller.

Another document akin to the Mississippi Motor Vehicle Bill of Sale is the Vehicle Title. This document is essential for proving ownership of a vehicle. In many cases, the title must be signed over to the new owner at the time of sale, similar to how a Bill of Sale is used. Both documents can be required when registering the vehicle with the state, and they work together to provide a complete record of the transaction and ownership history.

The Purchase Agreement is another relevant document. This formal contract outlines the terms and conditions of the sale, including payment details and any contingencies. While a Bill of Sale serves as a receipt for the transaction, a Purchase Agreement may include more extensive information about the sale process. Both documents aim to protect the interests of both parties and clarify the expectations surrounding the sale.

In addition, the Odometer Disclosure Statement is similar in that it is often required during vehicle sales. This document records the vehicle's mileage at the time of sale, which is crucial for preventing odometer fraud. Like the Bill of Sale, it provides important information that can protect both the buyer and seller. It ensures that the buyer is aware of the vehicle's condition and history before completing the purchase.

The Affidavit of Ownership can also be compared to the Mississippi Motor Vehicle Bill of Sale. This document is used when a seller cannot provide a title for the vehicle, often due to loss or theft. The affidavit serves as a sworn statement asserting ownership, similar to how a Bill of Sale confirms the transfer of ownership. Both documents help facilitate the sale process, especially when there are complications regarding the title.

When engaging in a motorcycle sale in Arizona, it is essential to utilize documentation that clearly defines the terms of the transaction. Alongside the Motorcycle Bill of Sale, individuals should be informed about the various related forms that help in proving ownership and safeguarding the interests of both the buyer and the seller. For comprehensive templates and resources, you can visit Arizona PDFs, which offers valuable insights and tools for completing a seamless transaction.

The Release of Liability form is another document that complements the Bill of Sale. This form protects the seller by notifying the state that they are no longer responsible for the vehicle once it has been sold. By submitting this form, the seller can avoid potential liabilities related to accidents or violations committed by the new owner. It acts as a safeguard, ensuring that both parties understand their responsibilities post-sale.

The Power of Attorney can also relate to vehicle transactions. If a seller is unable to be present for the sale, they may grant someone else the authority to sign the Bill of Sale on their behalf. This document ensures that the transaction can proceed smoothly, even in the seller's absence. Both the Power of Attorney and the Bill of Sale help facilitate the legal transfer of ownership while respecting the seller's wishes.

Lastly, the IRS Form 8300 is similar in that it deals with large cash transactions, which may occur during the sale of a vehicle. If the sale price exceeds a certain threshold, the seller must report the transaction to the IRS. While the Bill of Sale documents the transfer of ownership, Form 8300 ensures compliance with tax regulations. Both documents are essential for maintaining legal and financial transparency during significant transactions.