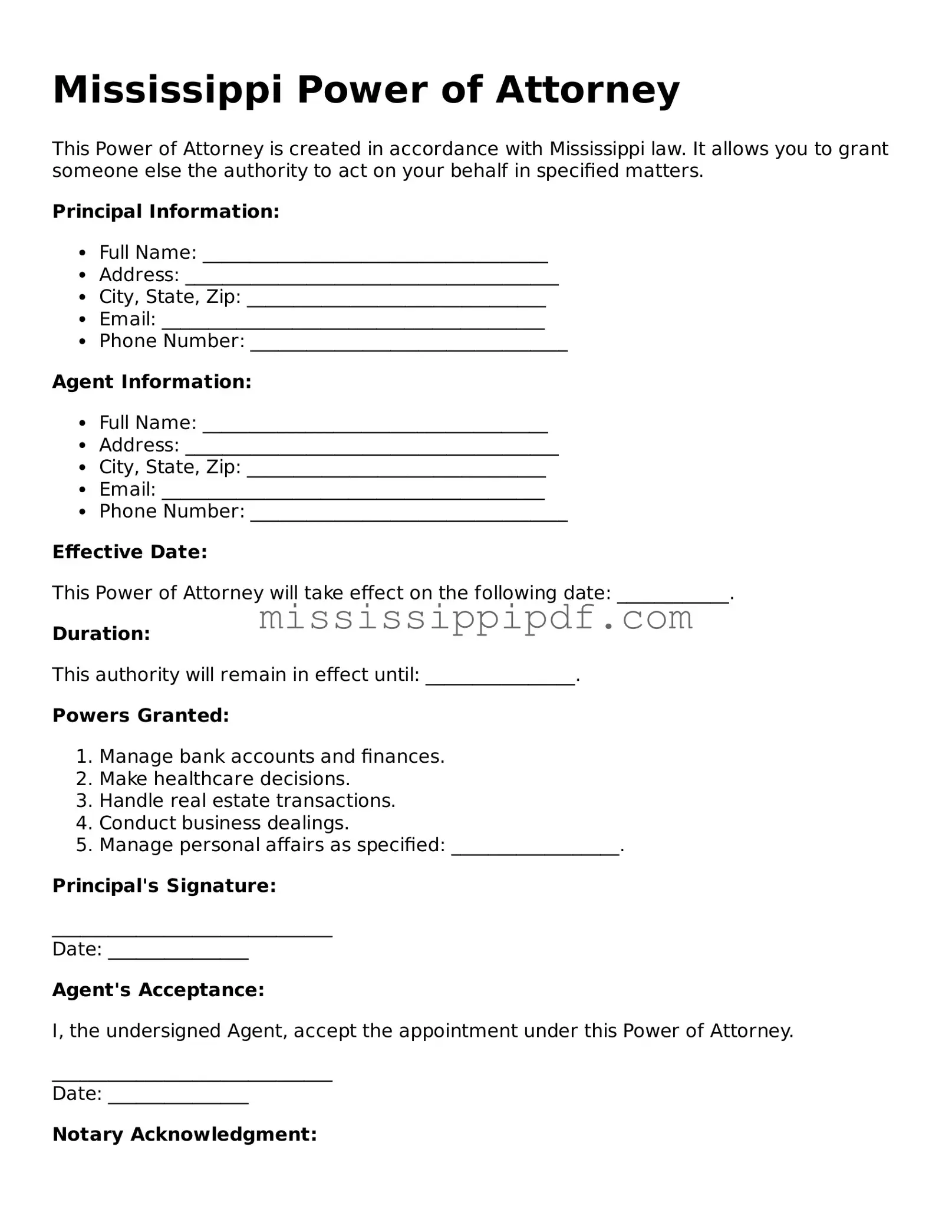

Fillable Power of Attorney Template for Mississippi

Popular Mississippi Templates

Problems With Transfer on Death Deeds in Indiana - It streamlines the process of passing down property, helping to prevent potential disputes or disagreements among survivors.

Vehicle Registration Mississippi - The Motor Vehicle Power of Attorney ensures a smoother experience during legal transactions.

For a smooth ownership transfer, it is advisable to utilize a precise California Trailer Bill of Sale document that encapsulates key transaction details. You can access the form easily by visiting the necessary California Trailer Bill of Sale documentation.

Home School Programs Mississippi - Communicates educational plans to local school officials.

Misconceptions

Understanding the Mississippi Power of Attorney form is essential for anyone considering this legal document. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

-

All Power of Attorney forms are the same.

In reality, Power of Attorney forms can vary significantly by state. The Mississippi form has specific requirements that differ from other states.

-

A Power of Attorney is only for financial matters.

This is not true. A Power of Attorney can cover various areas, including medical decisions, property management, and legal matters.

-

Once a Power of Attorney is signed, it cannot be revoked.

This misconception is incorrect. A principal can revoke the Power of Attorney at any time, as long as they are mentally competent.

-

The agent must be a lawyer.

While many choose an attorney, it is not required. An agent can be any trustworthy person, such as a family member or friend.

-

A Power of Attorney is only useful for elderly individuals.

This is misleading. People of all ages can benefit from having a Power of Attorney, especially in case of unexpected health issues.

-

The Power of Attorney takes effect immediately.

Some forms are durable and take effect right away, while others can be set to activate only under specific conditions, such as incapacitation.

-

Once the principal dies, the Power of Attorney remains valid.

This is false. A Power of Attorney ends upon the death of the principal, and the agent can no longer act on their behalf.

Being informed about these misconceptions can help individuals make better decisions regarding the Mississippi Power of Attorney form.

Documents used along the form

When preparing a Mississippi Power of Attorney, it is often helpful to consider additional documents that may complement or support its use. These documents can provide clarity and further instruction regarding financial or healthcare decisions. Below is a list of five common forms that are frequently used alongside a Power of Attorney.

- Advance Healthcare Directive: This document outlines an individual's preferences for medical treatment in the event they become unable to communicate their wishes. It ensures that healthcare providers and family members understand the person's desires regarding life-sustaining measures and other medical interventions.

- Living Will: A Living Will is a specific type of advance directive that focuses solely on end-of-life care. It details the types of medical treatments a person wishes to receive or decline if they are terminally ill or in a persistent vegetative state.

- Durable Power of Attorney for Healthcare: This form grants someone the authority to make healthcare decisions on behalf of another person if they become incapacitated. Unlike a general Power of Attorney, this document specifically addresses medical decisions and may include instructions for treatment preferences.

- Durable Power of Attorney: To establish a solid foundation for your legal and financial decisions, explore the essential Durable Power of Attorney form resources that guide individuals in designating trusted representatives.

- Financial Power of Attorney: Similar to a general Power of Attorney, this document allows a designated person to manage financial affairs. It can cover a wide range of financial decisions, from paying bills to managing investments, ensuring that financial matters are handled smoothly if the principal is unable to do so.

- Will: A Will is a legal document that outlines how a person wishes their assets to be distributed after their death. While not directly related to a Power of Attorney, having a Will in place can provide peace of mind regarding the management of one's estate and final wishes.

Considering these documents alongside the Mississippi Power of Attorney can help ensure that your wishes are clearly communicated and respected. Each document serves a unique purpose, providing a comprehensive approach to managing both healthcare and financial decisions during challenging times.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A Mississippi Power of Attorney form allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf. |

| Governing Law | The Mississippi Power of Attorney is governed by the Mississippi Code, specifically Title 87, Chapter 3. |

| Types | There are various types of Power of Attorney in Mississippi, including durable, non-durable, and springing powers of attorney. |

| Durable Power of Attorney | A durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Agent's Authority | The agent's authority can be broad or limited, depending on the principal's wishes outlined in the document. |

| Signing Requirements | The form must be signed by the principal and acknowledged before a notary public to be valid. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are competent to do so. |

| Legal Advice | It is advisable for individuals to seek legal counsel when creating a Power of Attorney to ensure it meets their specific needs. |

Key takeaways

When filling out and using the Mississippi Power of Attorney form, keep the following key takeaways in mind:

- Choose the right agent: Select someone you trust to act on your behalf. This person will have significant authority over your financial or legal matters.

- Be specific: Clearly outline the powers you are granting to your agent. This can include decisions about property, finances, or health care.

- Understand the limits: Know that you can limit the powers granted. You can specify certain tasks or time frames for your agent’s authority.

- Sign and date: Ensure that you sign and date the form in front of a notary public. This step is crucial for the document's validity.

- Keep copies: After completing the form, make several copies. Distribute them to your agent, financial institutions, and any relevant parties.

These steps will help ensure that your Power of Attorney is effective and meets your needs.

Similar forms

The Mississippi Power of Attorney form is similar to a Living Will. A Living Will allows individuals to express their wishes regarding medical treatment in case they become unable to communicate those wishes themselves. Both documents empower someone to make decisions on behalf of another person. However, while a Power of Attorney can cover a wide range of decisions, including financial matters, a Living Will specifically focuses on healthcare preferences. This ensures that an individual's medical choices are respected even when they cannot voice them directly.

Another document that shares similarities with the Power of Attorney is the Healthcare Proxy. This document designates someone to make medical decisions for a person if they are incapacitated. Like the Power of Attorney, a Healthcare Proxy allows individuals to choose a trusted person to act on their behalf. The key difference lies in the scope; the Healthcare Proxy is limited to health-related decisions, while the Power of Attorney can also handle financial and legal matters. This distinction is important for comprehensive planning.

A Trust is also comparable to the Power of Attorney in that it involves the management of an individual’s assets. A Trust allows a person to place their assets under the control of a trustee for the benefit of designated beneficiaries. While a Power of Attorney grants authority to manage financial affairs while the individual is still alive, a Trust can continue to manage assets after death. Both documents require careful consideration and trust in the appointed individual, but they serve different purposes in estate planning.

The Mississippi Power of Attorney form is similar to a Living Will. A Living Will allows individuals to express their wishes regarding medical treatment in case they become unable to communicate those wishes themselves. Both documents empower someone to make decisions on behalf of another person. However, while a Power of Attorney can cover a wide range of decisions, including financial matters, a Living Will specifically focuses on healthcare preferences. This ensures that an individual's medical choices are respected even when they cannot voice them directly. For those in need of related documentation, resources like Arizona PDFs can be invaluable.

Lastly, a Declaration of Guardian is similar to a Power of Attorney in that it allows individuals to designate someone to make decisions for them if they become incapacitated. This document specifically focuses on appointing a guardian for personal and financial matters. While a Power of Attorney can be revoked at any time, a Declaration of Guardian may have different legal implications and could be more difficult to change once established. Understanding these nuances is essential for effective planning and ensuring that your wishes are honored.