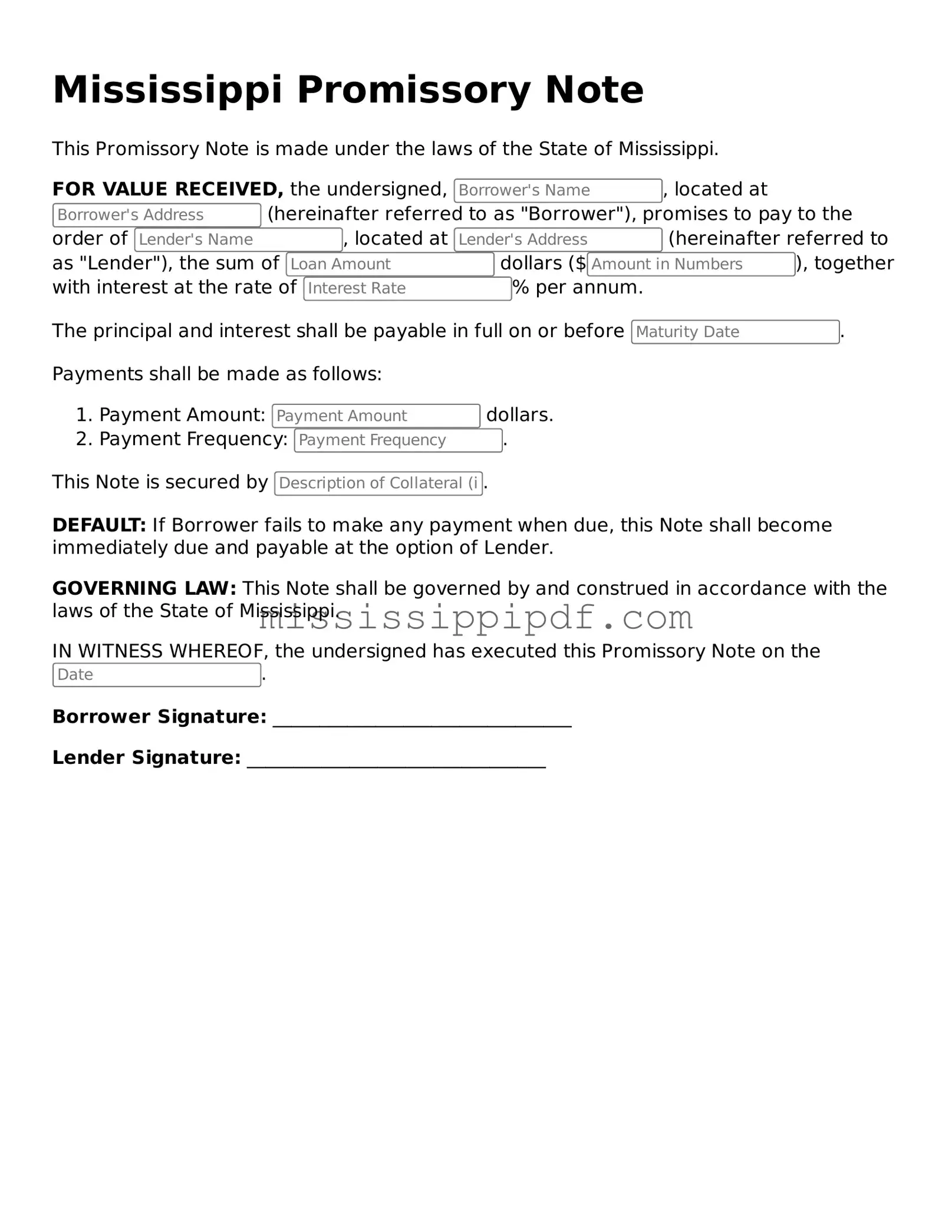

Fillable Promissory Note Template for Mississippi

Popular Mississippi Templates

How to Write an Employee Handbook - This form explains the use of company property and resources.

Completing the application process for financial assistance during temporary disability involves understanding several key components, including the necessity of submitting the EDD DE 2501 form. To ensure a smooth experience, applicants should familiarize themselves with the requirements and guidelines associated with this important document, such as the steps to access the Disability Insurance Claim Form effectively.

Ms Boat Bill of Sale - Legitimizes the sale by documenting the buyer and seller’s agreement.

How to Create an Operating Agreement - This document helps safeguard the interests of minority members in an LLC.

Misconceptions

Understanding the Mississippi Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions often arise regarding this important document. Below is a list of common misconceptions, along with clarifications to help clarify the truth.

- Misconception 1: A promissory note does not need to be in writing.

- Misconception 2: All promissory notes are the same.

- Misconception 3: The lender must charge interest.

- Misconception 4: A promissory note is the same as a loan agreement.

- Misconception 5: A promissory note does not require signatures.

- Misconception 6: Promissory notes are only for large loans.

- Misconception 7: You cannot modify a promissory note once it is signed.

- Misconception 8: Promissory notes are only used in commercial transactions.

This is incorrect. While verbal agreements can sometimes be enforceable, a written promissory note is essential for clarity and legal enforceability in Mississippi.

This is misleading. Promissory notes can vary significantly in terms of terms, interest rates, and conditions. It is crucial to use the appropriate form that meets specific legal requirements.

Not necessarily. While many promissory notes include interest, it is not a legal requirement. A lender may choose to provide a loan without interest.

This is a common misunderstanding. A promissory note is a promise to repay a loan, while a loan agreement typically includes additional terms and conditions regarding the loan.

This is false. Signatures from both the borrower and the lender are necessary to validate the document. Without signatures, the note may not be enforceable.

This is untrue. Promissory notes can be used for any amount of money, regardless of size. They serve as a formal record of the borrowing agreement.

This is incorrect. Modifications can be made, but they should be documented in writing and signed by both parties to ensure clarity and enforceability.

This is a misconception as well. Individuals can use promissory notes for personal loans between friends or family members, making them versatile financial tools.

Documents used along the form

The Mississippi Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender under specified terms. In addition to this note, several other forms and documents are commonly used in conjunction with it. These documents help clarify the terms of the loan, protect the interests of both parties, and ensure compliance with state laws.

- Loan Agreement: This document details the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured by collateral, this agreement outlines the collateral's specifics and the lender's rights in case of default.

- Personal Guarantee: A personal guarantee may be required from the borrower or a third party, ensuring that they will be personally responsible for the loan if the borrower defaults.

- Disclosure Statement: This document provides important information about the loan, including fees, interest rates, and other terms that the borrower should understand before signing.

- Payment Schedule: A separate schedule may be created to outline the specific dates and amounts due for each payment throughout the loan term.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components, helping borrowers understand how their payments will affect the loan balance over time.

- Default Notice: This document is issued if the borrower fails to make payments as agreed, notifying them of the default and potential consequences.

- Wyoming Promissory Note: This legal document outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. To get started on your own Promissory Note form, fill out the form by clicking the link.

- Release of Liability: Upon full repayment of the loan, this document releases the borrower from any further obligations under the promissory note.

- Loan Modification Agreement: If the terms of the loan need to be changed, this agreement outlines the new terms and conditions agreed upon by both parties.

- Notarized Affidavit: In some cases, a notarized affidavit may be required to verify the identities of the parties involved and the authenticity of the signatures on the promissory note.

These documents play a crucial role in the loan process, providing clarity and legal protection for both the lender and the borrower. Understanding each document's purpose can help ensure a smoother transaction and reduce the likelihood of disputes in the future.

File Overview

| Fact Name | Details |

|---|---|

| Definition | A Mississippi Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Governing Law | The Mississippi Uniform Commercial Code governs promissory notes in the state. |

| Parties Involved | The note typically involves a maker (the borrower) and a payee (the lender). |

| Interest Rates | Interest rates may be specified in the note, subject to state usury laws. |

| Payment Terms | Payment terms can include a lump sum or installment payments, depending on the agreement. |

| Default Conditions | Default conditions are outlined, specifying what constitutes a breach of the agreement. |

| Enforceability | A properly executed promissory note is legally enforceable in Mississippi courts. |

Key takeaways

Ensure that all parties involved clearly understand the terms of the note, including the loan amount, interest rate, and repayment schedule.

Complete the form accurately and legibly to avoid any misunderstandings or disputes in the future.

Both the borrower and lender should sign the document to validate the agreement and make it legally binding.

Keep a copy of the signed promissory note for personal records, as it serves as proof of the loan agreement.

Similar forms

A loan agreement is a document that outlines the terms and conditions under which a borrower receives funds from a lender. Like a Mississippi Promissory Note, it specifies the amount borrowed, the interest rate, and the repayment schedule. Both documents serve to protect the lender's rights while detailing the borrower's obligations. The main difference lies in the level of detail; a loan agreement often includes more extensive terms, such as collateral requirements and default consequences, while a promissory note is generally more straightforward.

A mortgage is another document that shares similarities with a Mississippi Promissory Note. When a borrower takes out a mortgage, they sign a promissory note to promise repayment and a mortgage deed to secure the loan against the property. Both documents include the loan amount and terms of repayment. However, the mortgage also involves the property itself as collateral, which adds a layer of security for the lender that is not present in a standard promissory note.

To ensure you have all necessary information before entering into any financial agreements, it is advisable to read the document related to Power of Attorney forms, as they may play a crucial role in authorizing someone to act on your behalf, especially in cases where you might be incapacitated or unable to manage your affairs personally.

An installment agreement is akin to a Mississippi Promissory Note as it outlines a repayment plan for a loan. Both documents specify the amount owed and the payment schedule. However, an installment agreement typically covers multiple payments over time, while a promissory note can be a single promise to pay back the loan in full at a later date. Both serve to clarify the expectations of repayment between the parties involved.

A personal guarantee is similar to a promissory note in that it involves a commitment to repay a debt. When an individual signs a personal guarantee, they agree to be personally responsible for a debt if the primary borrower defaults. This document often accompanies a promissory note, especially in business transactions, providing additional security for the lender. Both documents highlight the borrower's obligation to repay but differ in their scope and implications for personal liability.

A business loan agreement shares many characteristics with a Mississippi Promissory Note. It outlines the terms under which a business borrows money, detailing the amount, interest rate, and repayment schedule. Like a promissory note, it serves to protect the lender's interests. However, a business loan agreement may also include additional clauses related to business operations, financial reporting, and covenants that are not typically found in a standard promissory note.

A lease agreement can be similar to a promissory note when it includes a provision for rent payments. Both documents outline a financial obligation, detailing the amount due and the payment schedule. However, a lease agreement typically covers the use of property rather than a loan. In some cases, a lease may require a promissory note as a guarantee for payment, linking the two documents in a financial transaction.

A debt settlement agreement also resembles a Mississippi Promissory Note in that it involves a repayment plan for a debt. This document outlines the terms under which a borrower agrees to pay a reduced amount to settle a debt. Both documents aim to clarify the terms of repayment and protect the lender's interests. However, a debt settlement agreement often involves negotiations and may include terms for forgiveness of part of the debt, which is not typically part of a promissory note.