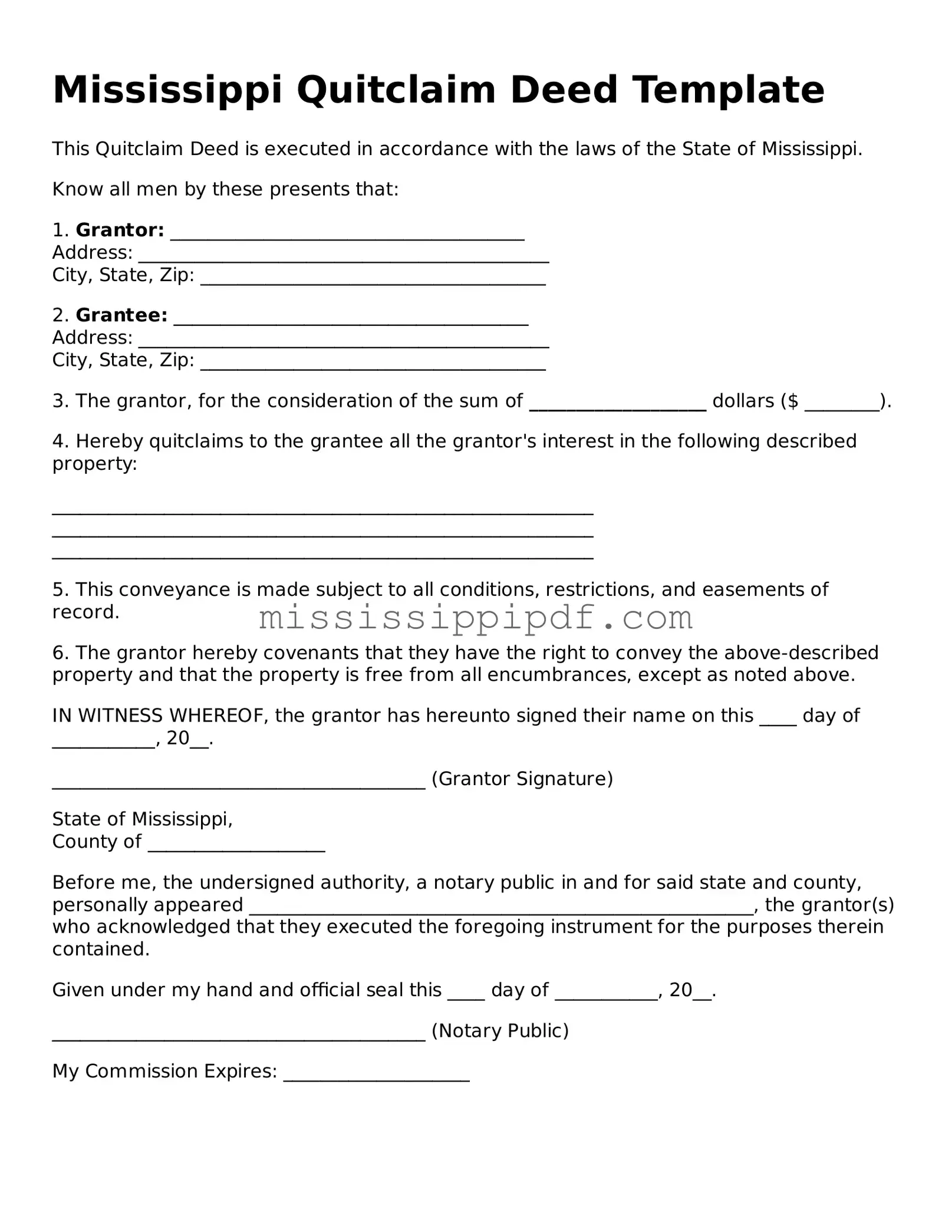

Fillable Quitclaim Deed Template for Mississippi

Popular Mississippi Templates

Mobile Home Bill of Sale Mississippi - Some sellers may offer financing terms that should be delineated in the Bill of Sale.

The Arizona Motor Vehicle Bill of Sale form serves as a legal document that records the transfer of ownership of a motor vehicle from one party to another. This form is essential for both buyers and sellers, as it provides proof of the transaction and details about the vehicle. To better understand the requirements and obtain a template for this document, visit Arizona PDFs. Proper completion of this document can help facilitate a smooth transfer and protect the interests of both parties involved.

How to Transfer a Deed in Mississippi - All parties should retain copies of the executed deed.

Contract for Purchase and Sale of Real Estate - This form can help ensure that both the buyer and seller are on the same page throughout the transaction.

Misconceptions

When it comes to property transfers, the Mississippi Quitclaim Deed is often misunderstood. Here are six common misconceptions about this legal document:

- Quitclaim Deeds Transfer Ownership Completely. Many believe that a quitclaim deed provides a full transfer of ownership rights. In reality, it only transfers whatever interest the grantor has in the property, which may be none at all.

- Quitclaim Deeds Are Only for Family Transfers. While it’s true that quitclaim deeds are frequently used among family members, they are not limited to familial transactions. Anyone can use a quitclaim deed to transfer property to another person or entity.

- Quitclaim Deeds Eliminate Liens and Mortgages. A common misconception is that using a quitclaim deed clears any existing liens or mortgages on the property. This is not the case; any outstanding debts remain attached to the property, regardless of the deed type.

- Quitclaim Deeds Are Not Legally Binding. Some people mistakenly believe that quitclaim deeds lack legal enforceability. However, when properly executed and recorded, they are legally binding documents that can be upheld in court.

- Quitclaim Deeds Are Always Quick and Easy. Although quitclaim deeds can simplify the transfer process, they still require careful attention to detail. Errors in the deed or failure to record it properly can lead to complications down the road.

- Quitclaim Deeds Are Only for Real Estate Transactions. While quitclaim deeds are most commonly associated with real estate, they can also be used to transfer other types of property, such as vehicles or personal belongings, depending on state laws.

Understanding these misconceptions can help individuals make informed decisions when considering a quitclaim deed for property transfers in Mississippi.

Documents used along the form

When dealing with property transfers in Mississippi, the Quitclaim Deed form is often accompanied by several other important documents. Each of these forms serves a specific purpose in ensuring a smooth and legally sound transaction. Below are five common forms and documents that are frequently used alongside the Quitclaim Deed.

- Warranty Deed: This document provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. Unlike a quitclaim deed, a warranty deed offers more protection to the buyer, ensuring that there are no hidden claims against the property.

- Property Transfer Tax Form: This form is required for reporting the transfer of property to the local tax authority. It helps in calculating any taxes owed due to the change in ownership and ensures compliance with local tax regulations.

- Title Search Report: Conducting a title search is crucial before completing a property transfer. This report outlines the history of the property title, revealing any liens, encumbrances, or claims that could affect ownership.

- California Trailer Bill of Sale Form: To streamline your trailer ownership transfer, explore our essential California trailer bill of sale documentation for a smooth transaction process.

- Affidavit of Value: This affidavit is used to declare the value of the property being transferred. It may be required for tax purposes and helps in establishing the fair market value of the property at the time of the transaction.

- Disclosure Statement: This document informs the buyer of any known issues with the property, such as structural problems or environmental hazards. It promotes transparency and protects both parties by ensuring that the buyer is aware of potential concerns.

Understanding these accompanying documents can greatly enhance the property transfer process. Each form plays a vital role in ensuring that the transaction is legally compliant and protects the interests of all parties involved.

File Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties or guarantees. |

| Governing Law | In Mississippi, quitclaim deeds are governed by the Mississippi Code Annotated § 89-1-1. |

| Parties Involved | The parties involved in a quitclaim deed are the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| No Warranty | Quitclaim deeds do not provide any warranty of title, meaning the grantor makes no promises about the property’s legal status. |

| Common Uses | These deeds are often used in divorce settlements, to clear up title issues, or to transfer property between family members. |

| Recording Requirement | To be effective against third parties, a quitclaim deed must be recorded in the county where the property is located. |

| Consideration | While consideration (payment) is not required, it is common to state a nominal amount for legal purposes. |

| Notarization | The quitclaim deed must be signed by the grantor in the presence of a notary public to be valid. |

| Tax Implications | There may be tax implications when transferring property, so consulting a tax advisor is advisable. |

Key takeaways

Filling out and using the Mississippi Quitclaim Deed form can be straightforward if you keep a few key points in mind. Here are some important takeaways:

- Understand the Purpose: A quitclaim deed transfers ownership of property without any guarantees. It’s often used between family members or to clear up title issues.

- Complete All Required Fields: Ensure that all sections of the form are filled out accurately. Missing information can lead to delays or complications.

- Signatures Matter: The deed must be signed by the grantor (the person transferring the property). Notarization is also required to validate the document.

- File with the County: After completing the deed, file it with the local county clerk’s office where the property is located. This step is crucial for the deed to be legally recognized.

- Consider Legal Advice: If you have questions or concerns about the deed, consulting with a legal professional can provide clarity and ensure everything is in order.

Similar forms

A warranty deed is often compared to a quitclaim deed because both are used to transfer property ownership. However, a warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. This means the buyer is protected against any future claims on the property. In contrast, a quitclaim deed offers no such assurances, making it a less secure option for buyers. Essentially, while both documents facilitate the transfer of property, a warranty deed comes with a promise of ownership integrity, whereas a quitclaim deed does not.

A grant deed is another document that shares similarities with a quitclaim deed. Like a quitclaim deed, a grant deed transfers ownership of property from one party to another. However, a grant deed includes certain warranties, such as the assurance that the property has not been sold to anyone else and that it is free from undisclosed encumbrances. This added layer of protection makes grant deeds more favorable for buyers compared to quitclaim deeds, which lack these guarantees.

A special warranty deed is also akin to a quitclaim deed but with some key differences. This type of deed only guarantees that the seller has not caused any issues with the title during their ownership. It protects the buyer from claims that arose while the seller owned the property but does not cover any problems that existed before that time. Thus, while it offers some assurances, a special warranty deed still does not provide the comprehensive protection found in a warranty deed.

A bargain and sale deed is similar to a quitclaim deed in that it transfers property without providing any warranties regarding the title. However, this type of deed typically implies that the seller has some interest in the property and has the right to transfer it. While a quitclaim deed can be used even when the seller has no ownership interest, a bargain and sale deed suggests a more formal transfer of rights, even if it does not guarantee a clear title.

The California Articles of Incorporation form is a legal document required to establish a corporation in the state of California. This form outlines essential information about the corporation, including its name, purpose, and structure. To get started on forming your corporation, fill out the Articles of Incorporation by clicking the button below. For more guidance, consider visiting California Templates.

A deed of trust, while not a direct equivalent to a quitclaim deed, serves a related purpose in property transactions. This document is used to secure a loan with real estate as collateral. In a deed of trust, the borrower conveys the property to a trustee, who holds the title until the loan is repaid. Although it does not transfer ownership outright like a quitclaim deed, it involves a legal instrument that relates to property rights and interests.

A leasehold deed can also be compared to a quitclaim deed in terms of transferring rights, but it does so in a different context. A leasehold deed conveys the right to use and occupy a property for a specified period. While a quitclaim deed transfers ownership, a leasehold deed grants temporary rights to the property. This distinction is important for understanding the nature of property rights being conveyed.

Finally, a life estate deed is another document that can be likened to a quitclaim deed. A life estate deed transfers property to a person for the duration of their life, after which the property passes to another designated individual. While a quitclaim deed transfers full ownership without restrictions, a life estate deed creates a more complex arrangement that limits the rights of the original owner. Both documents involve the transfer of property, but they serve different purposes and establish different rights for the parties involved.