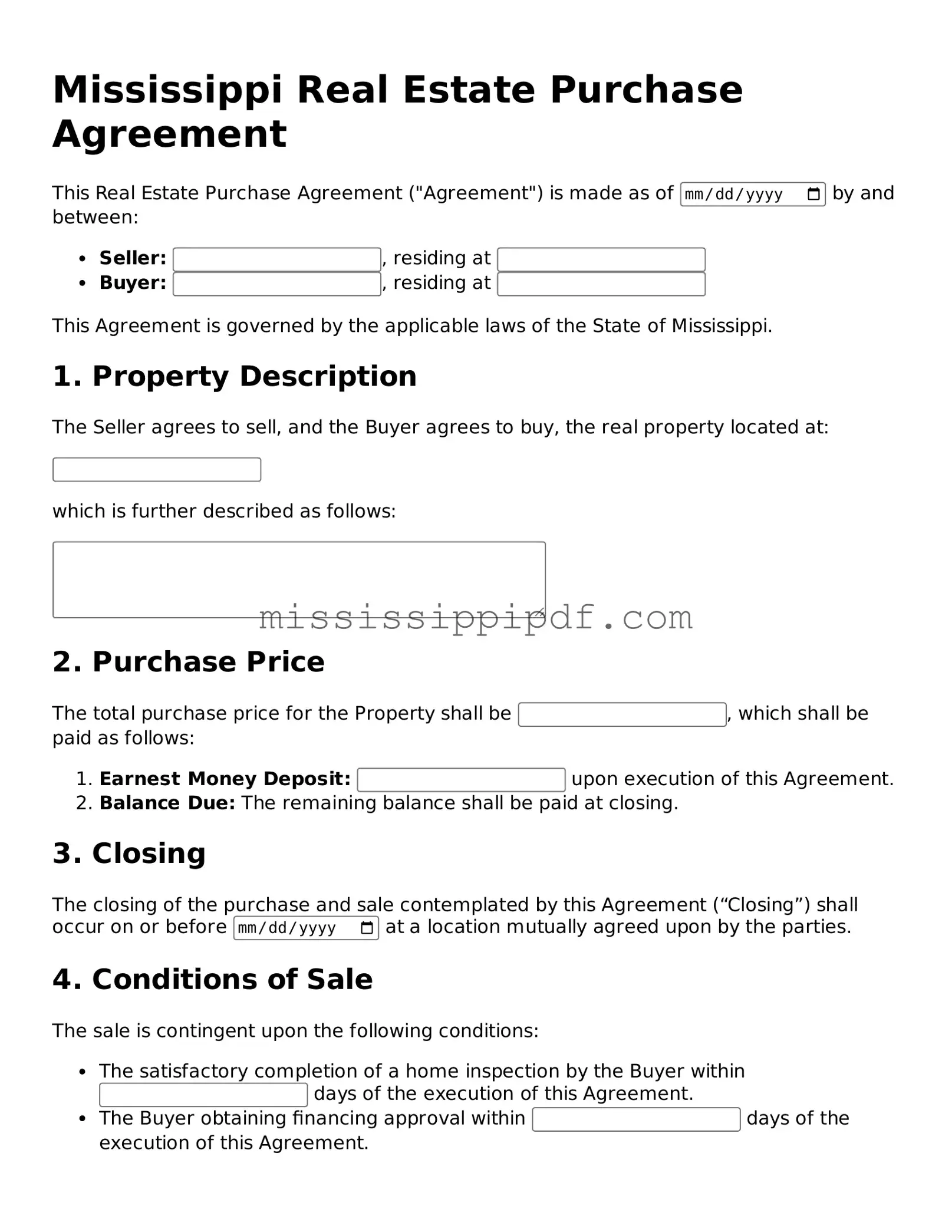

Fillable Real Estate Purchase Agreement Template for Mississippi

Popular Mississippi Templates

Lease Agreement Mississippi - Sets forth conditions under which a lease may be assigned to another party.

Completing the Florida Lottery DOL-129 form is crucial for any business aspiring to become an authorized lottery retailer, and detailed guidance on this process can be found at floridaforms.net/blank-florida-lottery-dol-129-form/, where applicants can navigate through the requirements such as fees, background checks, and necessary bonds to ensure they comply with all regulations set by the Florida Lottery.

How Do I Get a Dnr Form - The order does not mean that other forms of medical care will be withheld; it specifically addresses resuscitative efforts only.

Misconceptions

Misconceptions about the Mississippi Real Estate Purchase Agreement form can lead to confusion for buyers and sellers. Here are seven common misconceptions explained:

- It is a legally binding contract from the moment it is signed. While the agreement is intended to be binding, it often includes contingencies that must be met before it becomes fully enforceable.

- All real estate transactions require a purchase agreement. Not every real estate transaction requires a formal purchase agreement. Some transactions may be completed through other means, such as verbal agreements, though this is not advisable.

- Once signed, the terms cannot be changed. Terms can be modified if both parties agree to the changes in writing. Flexibility is often built into the negotiation process.

- The agreement protects the seller more than the buyer. The agreement is designed to protect both parties. It includes provisions that safeguard the interests of both the buyer and the seller.

- It is a standard form that cannot be customized. While there is a standard template, the agreement can be tailored to meet the specific needs of the transaction and the parties involved.

- Real estate agents handle all aspects of the agreement. While agents can provide assistance, buyers and sellers should review the agreement carefully and understand its terms before signing.

- It is only necessary to include the purchase price. The agreement should detail various terms, including contingencies, closing dates, and any included fixtures or appliances, not just the purchase price.

Documents used along the form

When navigating the process of buying or selling property in Mississippi, several key documents often accompany the Real Estate Purchase Agreement. Each of these forms serves a specific purpose and helps ensure a smooth transaction. Below is a list of common documents you might encounter.

- Property Disclosure Statement: This document provides essential information about the condition of the property. Sellers are required to disclose any known issues or defects, which helps buyers make informed decisions.

- Lead-Based Paint Disclosure: If the property was built before 1978, this form must be provided to buyers. It informs them of potential lead hazards and outlines the seller's obligations regarding lead paint.

- Title Commitment: This document is issued by a title company and outlines the legal status of the property. It details any liens, easements, or other encumbrances that may affect ownership.

- Medical Power of Attorney: This form allows individuals to designate someone to make healthcare decisions on their behalf. For more information, you can refer to Arizona PDFs.

- Closing Statement: Also known as a HUD-1 or ALTA statement, this document summarizes the financial aspects of the transaction. It includes details about the purchase price, closing costs, and any credits or adjustments.

- Deed: The deed is the legal document that transfers ownership from the seller to the buyer. It must be properly executed and recorded to ensure the buyer's rights to the property are protected.

Understanding these documents can significantly enhance your confidence in the real estate transaction process. Each form plays a vital role in protecting the interests of both buyers and sellers, ensuring a transparent and successful exchange of property.

File Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Mississippi Real Estate Purchase Agreement is governed by the laws of the State of Mississippi. |

| Purpose | This form is used to outline the terms and conditions under which a buyer agrees to purchase real estate from a seller. |

| Parties Involved | The agreement typically includes the names and contact information of both the buyer and the seller. |

| Property Description | A detailed description of the property being sold must be included, covering its address and legal description. |

| Purchase Price | The form specifies the total purchase price of the property and any earnest money deposit required. |

| Contingencies | Buyers may include contingencies, such as financing or inspection, which must be satisfied for the sale to proceed. |

| Closing Date | The agreement should state the anticipated closing date, which is when the property transfer will occur. |

| Signatures | Both parties must sign and date the agreement to make it legally binding. |

Key takeaways

When engaging in real estate transactions in Mississippi, understanding the Real Estate Purchase Agreement form is crucial. Here are key takeaways to consider:

- Clarity is Essential: Ensure that all terms and conditions are clearly stated. Ambiguities can lead to disputes later.

- Include All Parties: List all buyers and sellers involved in the transaction. This helps to avoid confusion and ensures that all parties are legally bound.

- Property Description: Provide a detailed description of the property being sold, including its address and any relevant boundaries or features.

- Purchase Price: Clearly state the agreed-upon purchase price and any deposit amounts. This is a fundamental aspect of the agreement.

- Contingencies: Outline any contingencies that must be met for the sale to proceed, such as financing or inspections. This protects both the buyer and seller.

- Closing Date: Specify the anticipated closing date. This helps to set expectations for both parties and facilitates planning.

- Disclosures: Be aware of any required disclosures about the property, such as known defects or issues. This is important for legal compliance.

- Signatures: Ensure that all parties sign the agreement. Without signatures, the document may not be enforceable.

Understanding these key points can facilitate a smoother transaction and help avoid potential legal complications in the future.

Similar forms

The Mississippi Real Estate Purchase Agreement is closely related to the Residential Purchase Agreement. Both documents serve the same primary purpose: to outline the terms and conditions under which a buyer agrees to purchase a residential property. They detail the purchase price, contingencies, and timelines. While the Residential Purchase Agreement is specific to homes, the Mississippi Real Estate Purchase Agreement can apply to various types of real estate, including commercial properties.

Another similar document is the Commercial Purchase Agreement. This agreement is tailored for transactions involving commercial properties. Like the Mississippi Real Estate Purchase Agreement, it includes essential details such as the purchase price and financing terms. However, the Commercial Purchase Agreement often has additional clauses addressing zoning laws, tenant rights, and other commercial considerations that are not typically found in residential agreements.

The Lease Agreement also shares similarities with the Mississippi Real Estate Purchase Agreement. While a Lease Agreement is primarily for rental situations, it still outlines terms related to property use, duration, and payment. Both documents aim to protect the interests of the parties involved, ensuring clarity on what is expected throughout the duration of the agreement, whether for purchase or lease.

The Option to Purchase Agreement is another related document. This agreement gives a potential buyer the right, but not the obligation, to purchase a property within a specified timeframe. It outlines the terms under which the buyer can exercise this option, similar to how the Mississippi Real Estate Purchase Agreement lays out the terms for a definitive sale. Both documents help clarify the intentions of the parties involved.

A Seller’s Disclosure Statement is also relevant in this context. While it does not serve as a purchase agreement, it is often provided alongside the Mississippi Real Estate Purchase Agreement. This document requires the seller to disclose any known issues with the property, which can significantly influence a buyer’s decision. Both documents work together to ensure transparency and informed decision-making.

The Escrow Agreement is another document that complements the Mississippi Real Estate Purchase Agreement. This agreement outlines the terms under which a neutral third party holds funds or documents until the conditions of the purchase agreement are met. Both documents are essential in facilitating a smooth transaction and ensuring that all parties fulfill their obligations before the sale is finalized.

The Counteroffer is a common occurrence in real estate transactions and is similar to the Mississippi Real Estate Purchase Agreement. When a seller or buyer wishes to change the terms of the initial offer, they create a counteroffer. This document outlines the new terms and conditions, similar to how the purchase agreement details the original terms of sale. Both documents are crucial in negotiating the final terms of the transaction.

The Mississippi Real Estate Purchase Agreement, like the California Articles of Incorporation, serves a crucial purpose in providing legal structure and clarity. Both documents outline essential terms and responsibilities, ensuring all parties understand their commitments. For those looking to streamline their corporate formation, resources like California Templates can be invaluable.

The Addendum to Purchase Agreement is another important document. This is used to modify or add specific terms to the original Mississippi Real Estate Purchase Agreement. It might address contingencies like repairs or additional disclosures. Both documents work together to ensure that all aspects of the transaction are clearly defined and agreed upon by both parties.

Lastly, the Title Commitment is related to the Mississippi Real Estate Purchase Agreement in that it provides information about the property’s title status. While it is not a purchase agreement itself, it is often reviewed during the transaction process. Both documents play vital roles in ensuring that the buyer is protected from any title issues that could arise after the sale.