Fillable Small Estate Affidavit Template for Mississippi

Popular Mississippi Templates

How to Transfer a Deed in Mississippi - Legal disputes can often arise over improperly drafted deeds.

The Arizona Motor Vehicle Bill of Sale form serves as a legal document that records the transfer of ownership of a motor vehicle from one party to another. This form is essential for both buyers and sellers, as it provides proof of the transaction and details about the vehicle. For more information and templates, you can visit Arizona PDFs. Proper completion of this document can help facilitate a smooth transfer and protect the interests of both parties involved.

Vehicle Bill of Sale Mississippi - It may include warranties or disclaimers about the motorcycle's condition.

Misconceptions

Understanding the Mississippi Small Estate Affidavit can help streamline the process of settling an estate. However, several misconceptions exist that can lead to confusion. Below are seven common misconceptions about this form:

- Only wealthy individuals can use the Small Estate Affidavit. Many people believe that this form is reserved for high-value estates. In reality, it is designed for estates that fall below a specific value threshold, making it accessible to a wider range of individuals.

- The Small Estate Affidavit can be used for any type of asset. Some think that all assets can be transferred using this affidavit. However, it typically applies only to certain types of assets, such as bank accounts and personal property, and may not cover real estate or other complex assets.

- Filing a Small Estate Affidavit is unnecessary if there is a will. Many assume that having a will negates the need for this affidavit. While a will is important, the Small Estate Affidavit provides a simplified process for transferring assets, even if a will exists.

- The Small Estate Affidavit process is the same in every state. Some people believe that the rules governing small estates are uniform across the country. Each state has its own laws and procedures, so it is crucial to understand Mississippi's specific requirements.

- All heirs must agree to use the Small Estate Affidavit. It is a common belief that unanimous consent from all heirs is necessary. While it is advisable to have agreement, the affidavit can still be filed by one heir, provided they meet the legal criteria.

- There is no deadline for filing the Small Estate Affidavit. Some individuals think they can take their time with this process. In fact, there are often time limits for filing, which can vary based on the circumstances surrounding the estate.

- Using a Small Estate Affidavit eliminates all legal responsibilities. Many believe that filing this affidavit absolves them of any further obligations. However, heirs may still have responsibilities related to debts and taxes, which must be addressed even after the affidavit is filed.

Being informed about these misconceptions can help individuals navigate the process of settling a small estate more effectively.

Documents used along the form

When dealing with the Mississippi Small Estate Affidavit, several other forms and documents may be necessary to ensure a smooth process in settling a decedent's estate. Each document serves a specific purpose and helps clarify the situation surrounding the estate. Below is a list of commonly used forms that accompany the Small Estate Affidavit.

- Death Certificate: This official document verifies the death of the individual whose estate is being settled. It is often required to establish the legal basis for the estate proceedings.

- Florida Lottery DOL-129 Form: This essential document for businesses looking to become authorized lottery retailers in Florida can be accessed at floridaforms.net/blank-florida-lottery-dol-129-form/, detailing the application process, fees, and necessary requirements.

- Will: If the deceased left a will, it is essential to present it during the estate settlement process. The will outlines the decedent's wishes regarding asset distribution.

- Inventory of Assets: This document lists all the assets owned by the decedent at the time of death. It helps determine the total value of the estate and what will be included in the small estate proceedings.

- Affidavit of Heirship: If there is no will, this affidavit identifies the legal heirs of the decedent. It serves as a declaration that outlines the family relationships and rights to the estate.

- Notice to Creditors: This document is used to inform creditors of the decedent's passing and provides them an opportunity to present any claims against the estate. It is an important step in ensuring that all debts are settled.

- Application for Letters of Administration: In cases where there is no will, this application may be necessary to appoint an administrator to manage the estate. It formally requests the court to grant authority to handle the estate's affairs.

Understanding these documents can simplify the process of settling an estate in Mississippi. Each plays a vital role in ensuring that the wishes of the deceased are honored and that all legal requirements are met.

File Overview

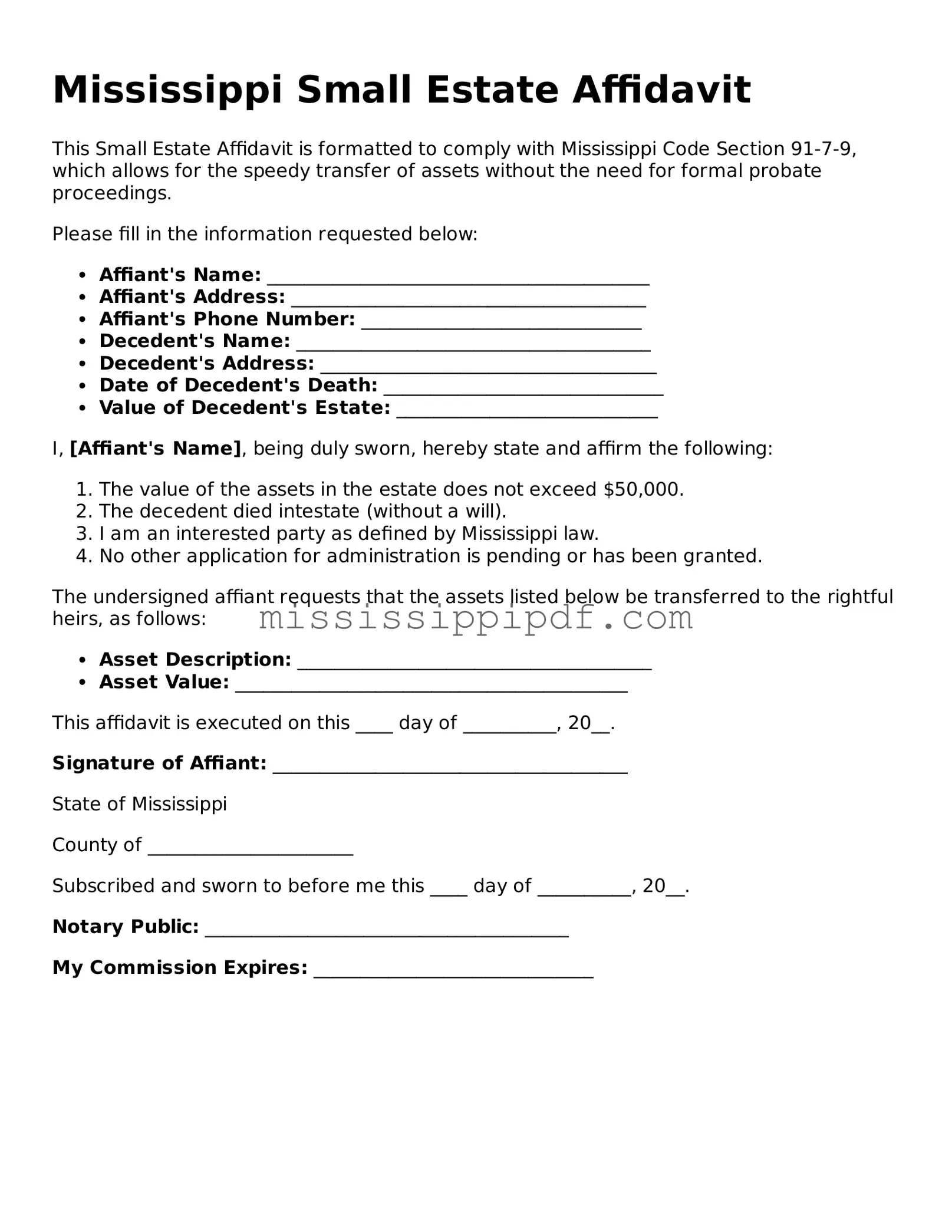

| Fact Name | Description |

|---|---|

| Purpose | The Mississippi Small Estate Affidavit form is used to simplify the process of transferring assets from a deceased person's estate when the total value is below a certain threshold. |

| Threshold Amount | As of 2023, the threshold for using this affidavit is $50,000 for personal property and $100,000 for real property. |

| Governing Law | This form is governed by Mississippi Code Annotated § 91-1-27, which outlines the procedures for small estate administration. |

| Eligibility | Only individuals who are entitled to inherit under Mississippi law, such as heirs or beneficiaries, can use this affidavit. |

| Required Information | The affidavit must include details such as the decedent's name, date of death, and a list of assets being claimed. |

| Filing Process | The completed affidavit must be filed with the appropriate probate court in the county where the decedent lived. |

| Legal Effect | Once filed, the affidavit serves as a legal document that allows the claimant to collect the decedent's assets without the need for formal probate proceedings. |

Key takeaways

Filling out and utilizing the Mississippi Small Estate Affidavit form can be a straightforward process for those managing the estate of a deceased individual. Below are key takeaways to consider when approaching this important task.

- The Small Estate Affidavit is designed for estates with a total value of $50,000 or less, excluding certain types of property.

- It provides a simplified method for heirs to claim property without going through the lengthy probate process.

- Only certain individuals, such as the surviving spouse or next of kin, can file the affidavit.

- Proper completion of the form requires accurate information about the deceased, including their full name, date of death, and last known address.

- The affidavit must be signed in the presence of a notary public to ensure its validity.

- It is important to include a detailed list of the deceased's assets, as this will be critical for the affidavit's acceptance.

- Once filed, the affidavit serves as proof of entitlement to the estate's assets, allowing heirs to access them without further legal intervention.

- Heirs should retain copies of the affidavit and any supporting documents for their records, as these may be needed in future transactions.

Similar forms

The Mississippi Small Estate Affidavit is similar to the Affidavit of Heirship, which is used to establish the rightful heirs of a deceased person's estate. This document helps clarify who inherits the assets when there is no will. It typically includes information about the deceased, the heirs, and any relevant relationships. Just like the Small Estate Affidavit, it is often used to simplify the process of transferring property without going through probate, ensuring that heirs can access their inheritance more quickly.

Another document that shares similarities is the Will. A Will outlines how a person wishes their assets to be distributed after their death. While the Small Estate Affidavit can be used when there is no will, both documents aim to facilitate the transfer of assets. A Will provides clear instructions, whereas the Small Estate Affidavit serves as a means to claim assets without lengthy legal proceedings, especially for smaller estates.

For those looking to utilize a legal document for trailer ownership transfer, the essential Trailer Bill of Sale document is a valuable resource. This form provides a streamlined process for ensuring all necessary details are accurately noted, allowing for a smooth transition between parties involved in the sale.

The Declaration of Informal Probate also resembles the Small Estate Affidavit. This document is used to initiate a simplified probate process when the estate is small and uncontested. Both documents aim to expedite the distribution of assets, reducing the burden on the court system. However, the Declaration of Informal Probate requires a court's approval, while the Small Estate Affidavit allows heirs to claim assets directly without court involvement, provided they meet certain criteria.

Lastly, the Transfer on Death Deed is another document that functions similarly. This deed allows a property owner to designate beneficiaries who will receive the property upon their death, bypassing probate entirely. Like the Small Estate Affidavit, it simplifies the transfer process and is particularly useful for small estates. Both documents focus on ensuring that assets are transferred efficiently and with minimal legal hurdles, making it easier for heirs to inherit what they are entitled to.