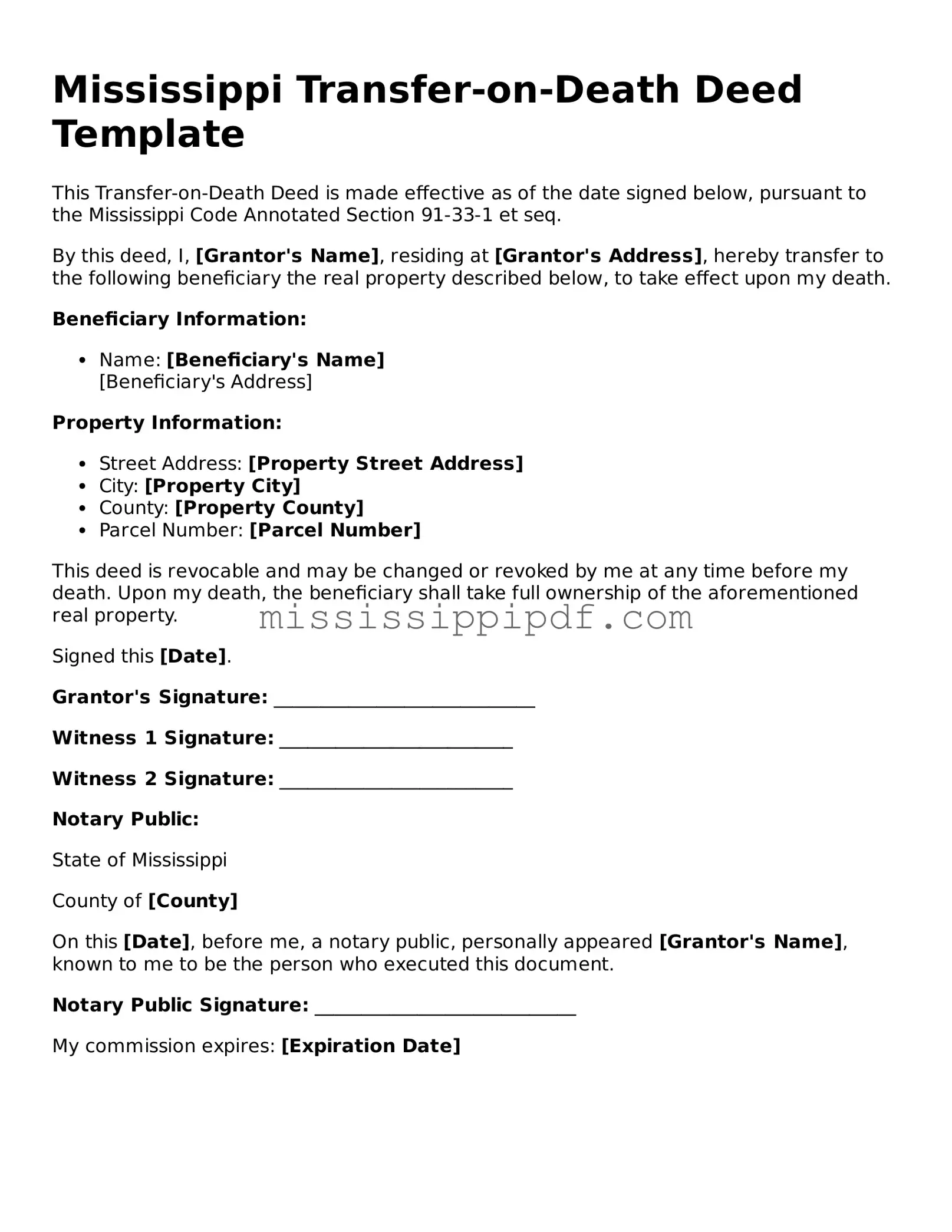

Fillable Transfer-on-Death Deed Template for Mississippi

Popular Mississippi Templates

Ms Power of Attorney - A practical solution for divorced or separated parents to designate authority.

Mississippi Premarital Agreement - It is a tool for establishing a shared vision for future finances.

For those navigating the complexities of a vehicle sale, understanding the key points of a thorough Vehicle Purchase Agreement overview can be invaluable in ensuring a smooth transaction.

Mississippi Power of Attorney Rules - You can use a Power of Attorney to appoint a trusted friend or family member as your representative.

Misconceptions

- Misconception 1: The Transfer-on-Death Deed is only for wealthy individuals.

- Misconception 2: A Transfer-on-Death Deed avoids all probate processes.

- Misconception 3: The Transfer-on-Death Deed is irrevocable once signed.

- Misconception 4: The Transfer-on-Death Deed automatically transfers property upon signing.

- Misconception 5: All property types can be transferred using a Transfer-on-Death Deed.

- Misconception 6: The Transfer-on-Death Deed can only name one beneficiary.

- Misconception 7: There are no tax implications with a Transfer-on-Death Deed.

- Misconception 8: The Transfer-on-Death Deed is the same as a will.

This is not true. The Transfer-on-Death Deed can be utilized by anyone who owns real property in Mississippi, regardless of their financial status. It is a tool designed to simplify the transfer of property upon death.

While this deed allows for the transfer of property without going through probate, it does not eliminate the need for probate in all cases. Certain circumstances, such as outstanding debts or disputes, may still require probate proceedings.

This is incorrect. The property owner retains the right to revoke or change the deed at any time during their lifetime, as long as they follow the proper procedures for revocation.

This deed does not transfer ownership until the property owner passes away. Until that time, the owner maintains full control over the property.

This deed is limited to real property. It cannot be used for personal property or financial assets, such as bank accounts or stocks.

In fact, multiple beneficiaries can be designated in a Transfer-on-Death Deed. This allows property owners to plan for different heirs as they see fit.

While the deed itself does not trigger taxes at the time of transfer, beneficiaries may still face tax obligations upon inheriting the property, depending on various factors.

This is a common misunderstanding. A will outlines how a person's entire estate should be distributed after death, while a Transfer-on-Death Deed specifically addresses the transfer of real property only.

Documents used along the form

The Mississippi Transfer-on-Death Deed is a valuable tool for property owners looking to transfer real estate upon their passing without going through probate. However, several other forms and documents may be necessary to ensure a smooth transition of property ownership. Below is a list of these important documents, each serving a specific purpose in the estate planning process.

- Last Will and Testament: This document outlines how a person's assets, including property, should be distributed after their death. It can provide additional instructions that may not be covered by the Transfer-on-Death Deed.

- Durable Power of Attorney: This form allows an individual to designate someone else to manage their financial affairs if they become incapacitated. It ensures that decisions can be made on behalf of the property owner when they are unable to do so.

- Healthcare Power of Attorney: Similar to the Durable Power of Attorney, this document allows an individual to appoint someone to make medical decisions on their behalf if they are unable to communicate their wishes.

- Living Will: This document specifies an individual’s preferences regarding medical treatment and end-of-life care. It provides clarity to family members and healthcare providers about the person’s wishes.

- Beneficiary Designation Forms: These forms are used for financial accounts, insurance policies, and retirement plans to designate beneficiaries who will receive the assets upon the owner's death, ensuring a streamlined transfer.

- Quitclaim Deed: This form transfers ownership of property from one party to another without any warranties. It is often used to add or remove someone from the property title, which may be relevant in estate planning.

- Affidavit of Heirship: This document establishes the heirs of a deceased person and can help in clarifying property ownership, especially when there is no will or formal estate administration.

- Bill of Sale: This document is vital for transferring ownership of personal property and is essential for both buyers and sellers, providing a clear record of the transaction. For more information, you can refer to the Bill of Sale form.

- Trust Agreement: A trust can hold assets during a person’s lifetime and specify how those assets are to be distributed after their death. It can provide privacy and avoid probate, complementing the Transfer-on-Death Deed.

- Deed of Gift: This document allows a property owner to transfer ownership of property as a gift while they are still alive, which can be part of a broader estate planning strategy.

Understanding these documents and their functions can significantly aid in effective estate planning. Each form plays a critical role in ensuring that your wishes are honored and that your loved ones are taken care of after your passing. It is advisable to consult with a legal professional to determine the best combination of documents for your specific situation.

File Overview

| Fact Name | Details |

|---|---|

| Purpose | The Mississippi Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The use of the Transfer-on-Death Deed in Mississippi is governed by Mississippi Code Annotated § 89-1-1 to § 89-1-7. |

| Eligibility | Any individual who owns real property in Mississippi can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property after their death. |

| Revocation | The Transfer-on-Death Deed can be revoked at any time by the property owner, provided the revocation is properly executed and recorded. |

| Recording Requirements | The deed must be recorded with the appropriate county clerk's office in Mississippi to be valid. |

| Tax Implications | There are no immediate tax consequences for the transfer of property via a Transfer-on-Death Deed until the beneficiary sells the property. |

Key takeaways

Filling out and using the Mississippi Transfer-on-Death Deed form can be a straightforward process, but it is crucial to understand the key elements involved. Here are seven important takeaways to consider:

- Eligibility: The Transfer-on-Death Deed is available for individuals who own real property in Mississippi. Ensure that you meet the eligibility requirements before proceeding.

- Beneficiary Designation: You must clearly designate one or more beneficiaries who will inherit the property upon your death. This designation is essential for the deed to be effective.

- Execution Requirements: The deed must be signed by the owner in the presence of a notary public. This step is vital to ensure that the deed is legally binding.

- Filing the Deed: After execution, the deed must be filed with the appropriate county clerk’s office where the property is located. Timely filing is critical to avoid complications.

- Revocation: You have the right to revoke or change the Transfer-on-Death Deed at any time before your death. This can be done by filing a revocation form or creating a new deed.

- Tax Implications: Understand the potential tax implications for your beneficiaries. The property may be subject to estate taxes, so it is wise to consult a tax professional.

- Consultation Recommended: It is advisable to seek legal counsel when filling out the form. Professional guidance can help ensure that your intentions are accurately reflected and legally sound.

By keeping these key points in mind, you can navigate the process of using a Transfer-on-Death Deed in Mississippi with greater confidence and clarity.

Similar forms

The Mississippi Transfer-on-Death Deed (TODD) form is similar to a Living Trust. A Living Trust allows individuals to transfer their assets into a trust during their lifetime, which can then be distributed to beneficiaries upon their death. Both documents facilitate the seamless transfer of property without the need for probate, ensuring that the decedent's wishes are honored while minimizing delays and costs associated with estate settlement.

Another document comparable to the TODD is the Last Will and Testament. While a will outlines how a person's assets will be distributed after their death, it typically requires probate. In contrast, the TODD allows for the direct transfer of property to beneficiaries outside of probate, providing a more efficient means of asset distribution.

The Beneficiary Designation is also similar to the TODD. This document allows individuals to designate beneficiaries for specific accounts, such as retirement accounts or life insurance policies. Like the TODD, beneficiary designations bypass probate and ensure that assets are transferred directly to the named individuals upon the owner's death.

In the realm of motorcycle ownership, understanding the necessary documentation is vital; for instance, the Arizona PDFs provides essential templates that can aid buyers and sellers in accurately completing a Motorcycle Bill of Sale, thereby ensuring a clear and lawful transfer of ownership.

A Joint Tenancy with Right of Survivorship agreement shares similarities with the TODD. In this arrangement, two or more individuals hold title to a property together. Upon the death of one owner, the surviving owner(s) automatically inherit the deceased owner's share, avoiding probate. The TODD serves a similar purpose by allowing property to pass directly to designated beneficiaries.

The Enhanced Life Estate Deed, often referred to as a Lady Bird Deed, is another document that resembles the TODD. This deed allows property owners to retain control over their property during their lifetime while designating beneficiaries who will inherit the property upon their death. Like the TODD, it avoids probate and simplifies the transfer process.

A Transfer-on-Death Account (TOD Account) is akin to the TODD. This financial account allows individuals to name beneficiaries who will receive the account's assets upon the account holder's death. Similar to the TODD, the transfer occurs outside of probate, ensuring a quick and straightforward transition of assets.

The Assignment of Property Rights document can also be compared to the TODD. This document allows individuals to assign their property rights to another party, effective upon their death. Both the Assignment and the TODD facilitate the transfer of property without the complications of probate, making the process smoother for beneficiaries.

The Family Limited Partnership (FLP) shares characteristics with the TODD as well. In an FLP, family members can pool their resources and manage assets collectively. Upon the death of a partner, their share can be transferred to heirs without going through probate, similar to how a TODD allows for direct transfer of property to designated beneficiaries.

Lastly, the Power of Attorney document, while not directly comparable in function, does share some similarities with the TODD in terms of control over property. A Power of Attorney allows an individual to designate someone else to manage their affairs, including property, during their lifetime. While it does not facilitate post-death transfers like the TODD, both documents empower individuals to make decisions regarding their property and ensure that their wishes are respected.